Blog

On the development of the SEK exchange rates & bond yields in March and Q1 2024

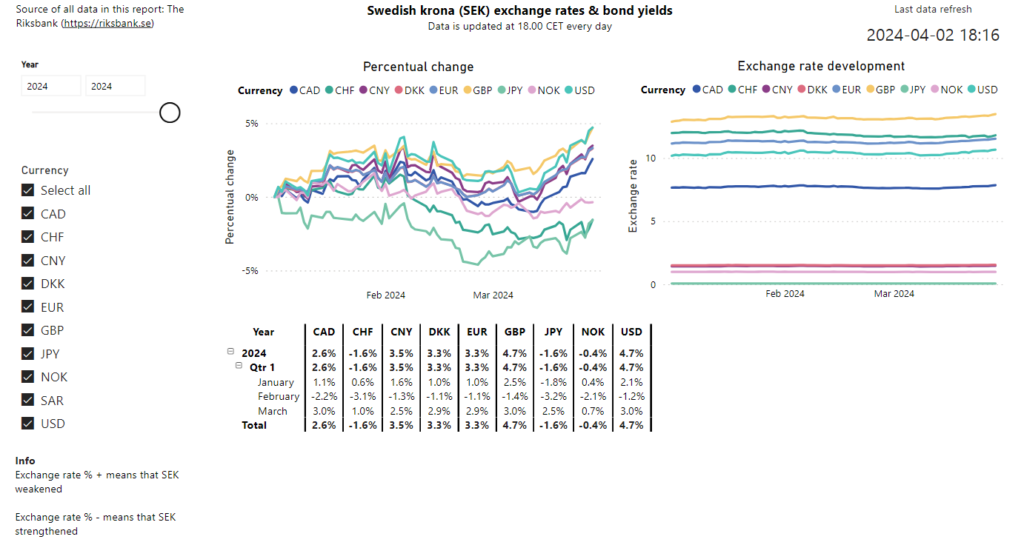

We analyse the development of the Swedish krona (SEK) exchange rates & bond yields in March and Q1 2024. We do the analysis by using a Power BI report, which is available in our Portfolio.

March 2024 overview

We filter the Power BI report so that only data up until and including 31st of March 2024 is included. We then start by going to the page with the exchange rates development, where we see that SEK weakened in March against all the currencies in the report. It weakened the most – by 3.0% – against CAD, GBP and USD and by 2.9% against EUR and DKK. In the period of just one month, this is a significant development of the exchange rates.

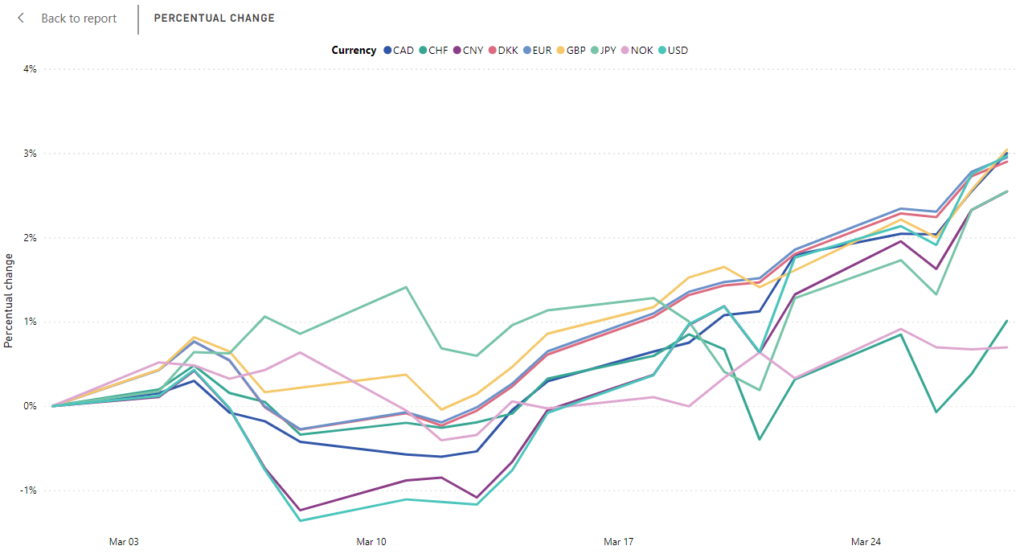

We then click on March in the table and the page is filtered with March as a filter. The chart below shows the percentual development in March 2024 only.

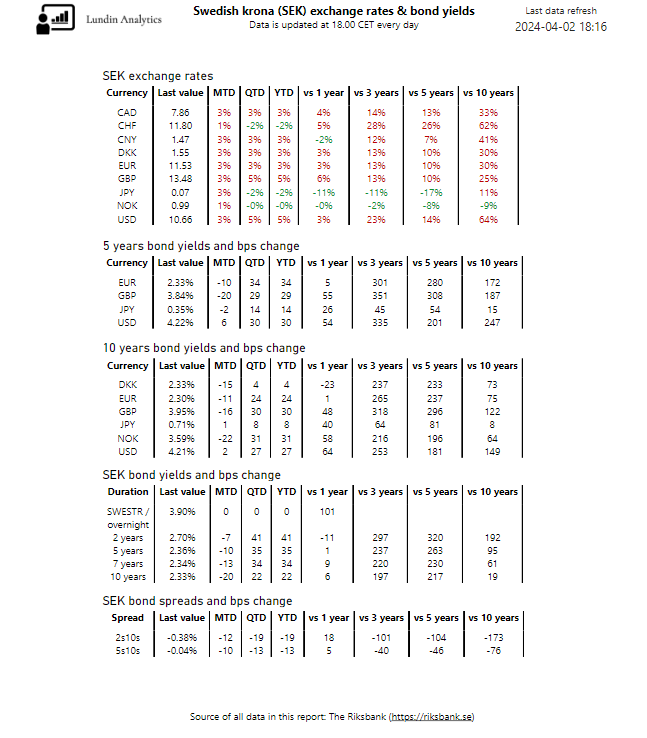

We see on the summary page that the bond yields have increased significantly year-to-date (YTD) for most of the bonds in the report. However, in March there was a clear decrease in most bond yields. For example, the SEK 10 years yield decreased by 20 bps in March and GBP 10 years yield decreased by 16 bps. The USD yields increased in March – 5 years increased by 6 bps and 10 years by 2 bps.

Q1 2024 overview

For the first quarter, the SEK strengthened against several currencies to begin with, up until March. We also described this in our post on the February 2024 SEK exchange rates development. In March, however, SEK weakened and this is largely the trend YTD as well. So far in 2024, the SEK development is within the range -2% to 5%. Some notable SEK exchange rates changes so far in 2024 are:

- Strengthening against JPY by 1.6%

- Strengthening against CHF by 1.6%

- Weakening against EUR by 3.3%

- Weakening against GBP by 4.7%

- Weakening against USD by 4.7%

The bond yields have increased during the quarter for all bonds in the report. For example, SEK 2 years yield increased by 41 bps and the 10 years by 22 bps. The GBP 10 years increased by 30 bps and USD 10 years by 27 bps.

With regards to the bond spreads, that is, the difference between short-term bonds and long-term bonds, decreased in the quarter for SEK. The 2s10s bond spread decreased by 19 bps to -0.38%, meaning that the 2 years yield increased more (+41 bps) than the 10 years yield (+22 bps).

Summary

In March 2024, the SEK weakened against several large currencies. For example, it weakened by 3.0% against both GBP and USD and by 2.9% against EUR. Bond yields decreased in March for all the bonds in the report except for the USD and JPY. For example, the 10 years SEK yield decreased by 20 bps in March.

While SEK started the year strengthening against several currencies, it has now weakened against large currencies like EUR (3.3%), GBP (4.7%) and USD (4.7%) and strengthened against for example JPY and CHF (1.6%).