Analysing the Swedish krona Short-Term Rate (SWESTR) Development using Power BI

Blog

Analysing the Swedish krona Short-Term Rate (SWESTR) development using Power BI

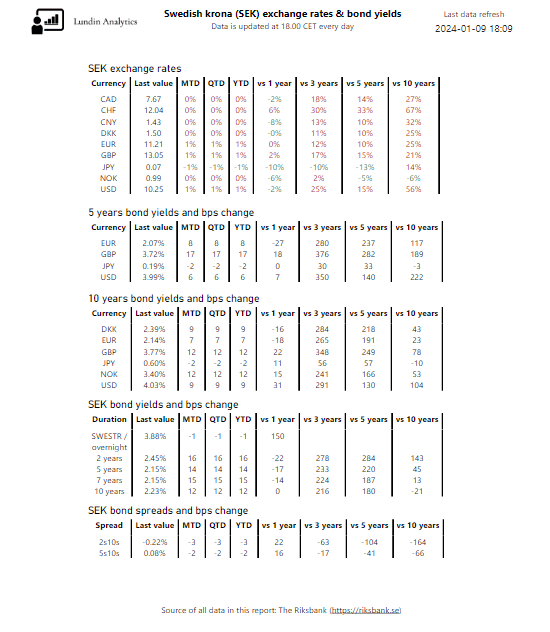

The Swedish krona Short-Term Rate (SWESTR) is a reference rate, meaning that it can be used as a reference for setting rates between banks. The SWESTR is completely based on transactions happening in the market and is published every bank day at Riksbanken’s website. It is intended to be used for loans with the shortest term, for example as a so called over-night rate (O/N rate) or tomorrow-next rate (T/N rate). For more information about SWESTR, please refer to this interview with a Riksbank representative.

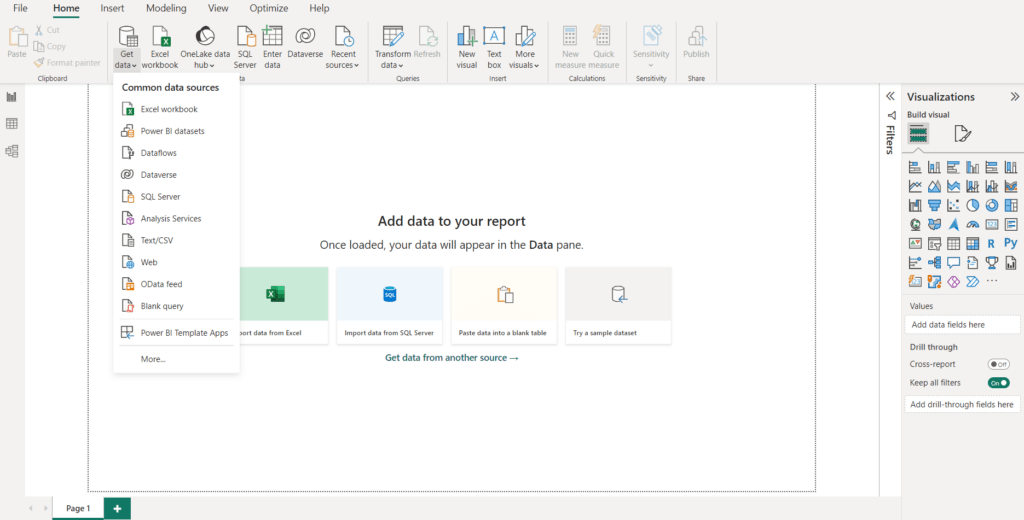

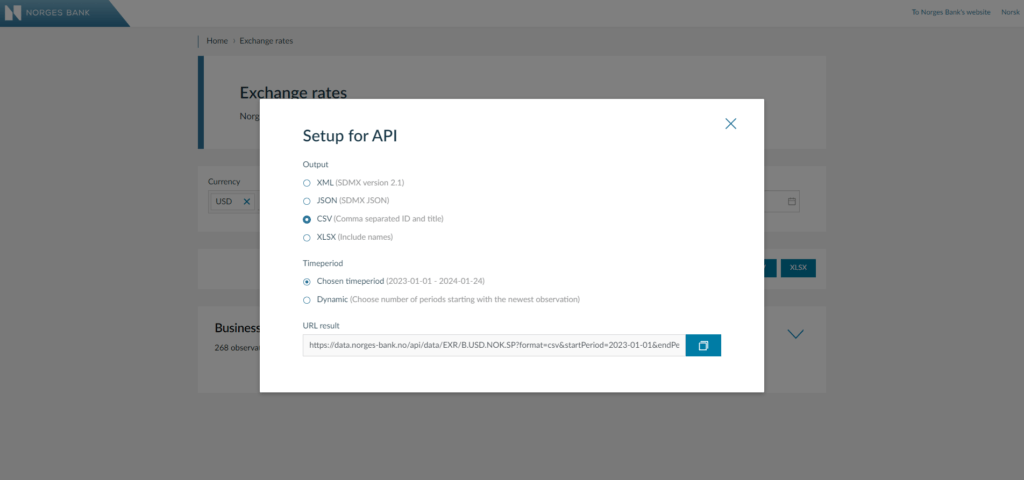

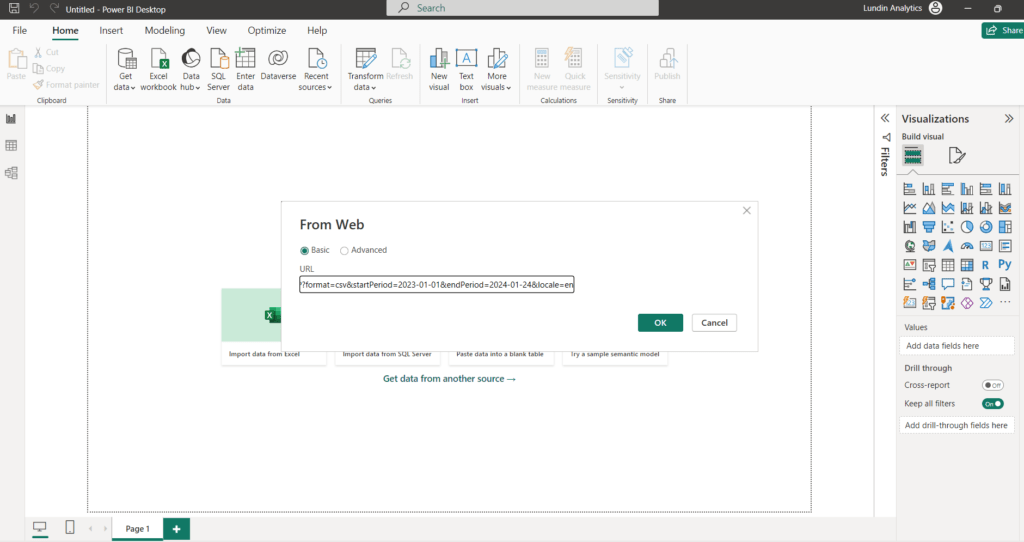

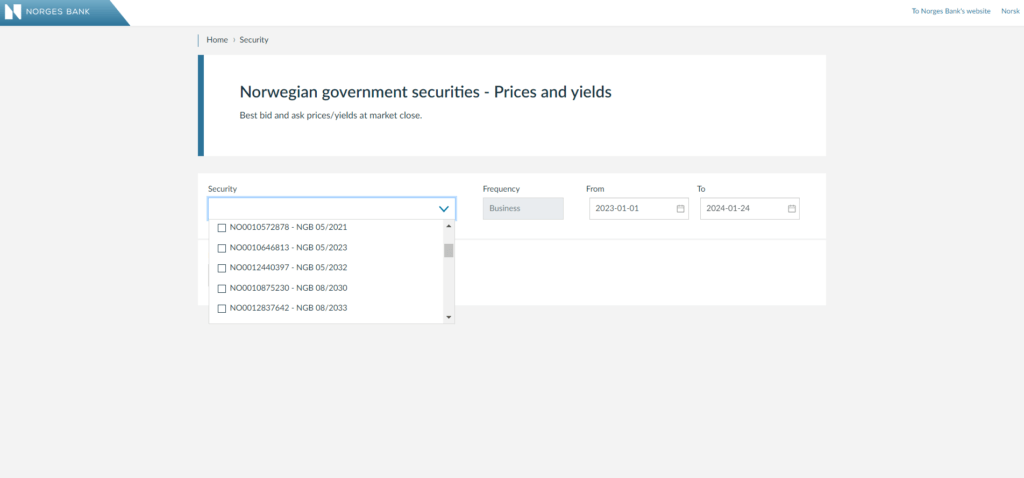

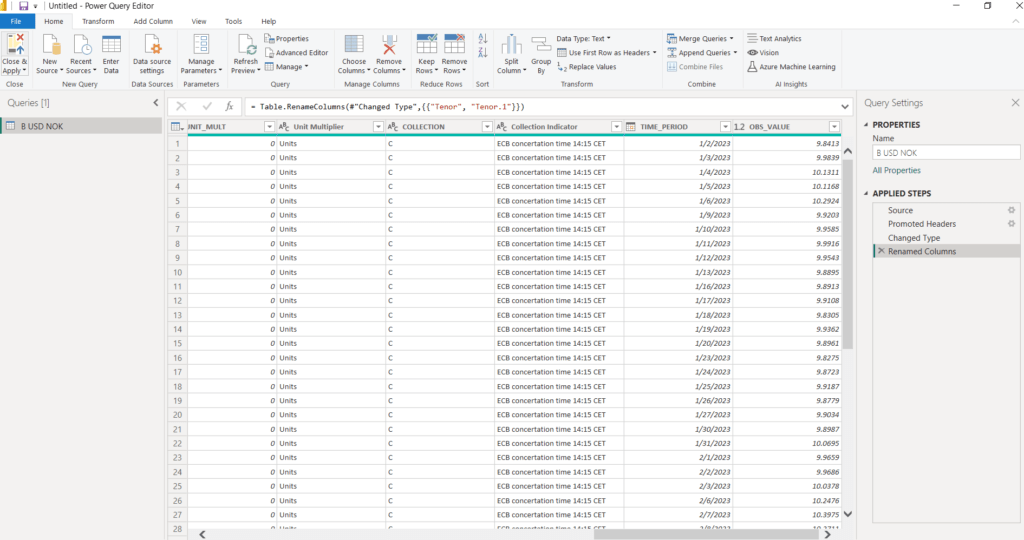

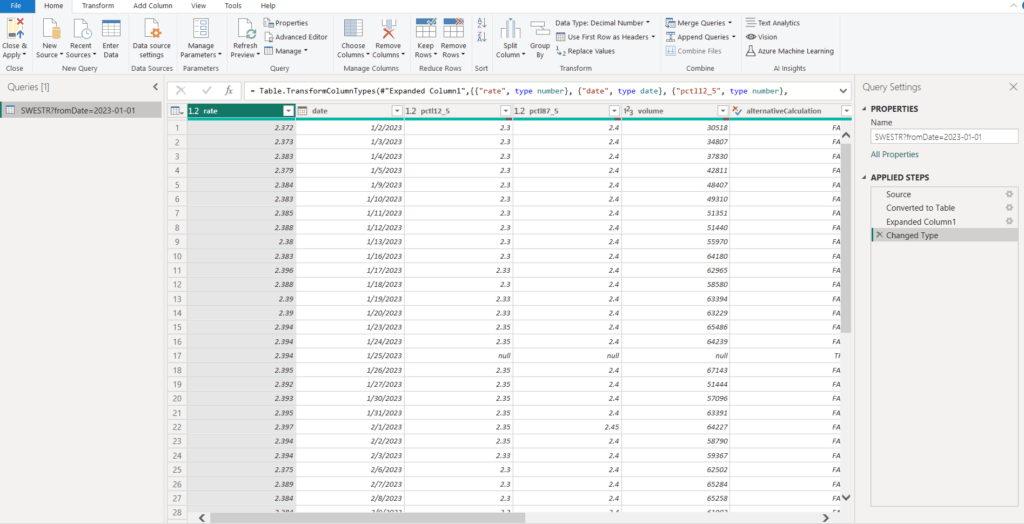

Reading data to Power BI using a REST API

The SWESTR went live in September 2021. Data is published each bank day and contains for example the current SWESTR rate, the volume and number of transactions. The data can be read by utilising the Riksbank’s REST API. In a previous blog post, we guided readers on how to read SWESTR data to Power BI via the REST API.

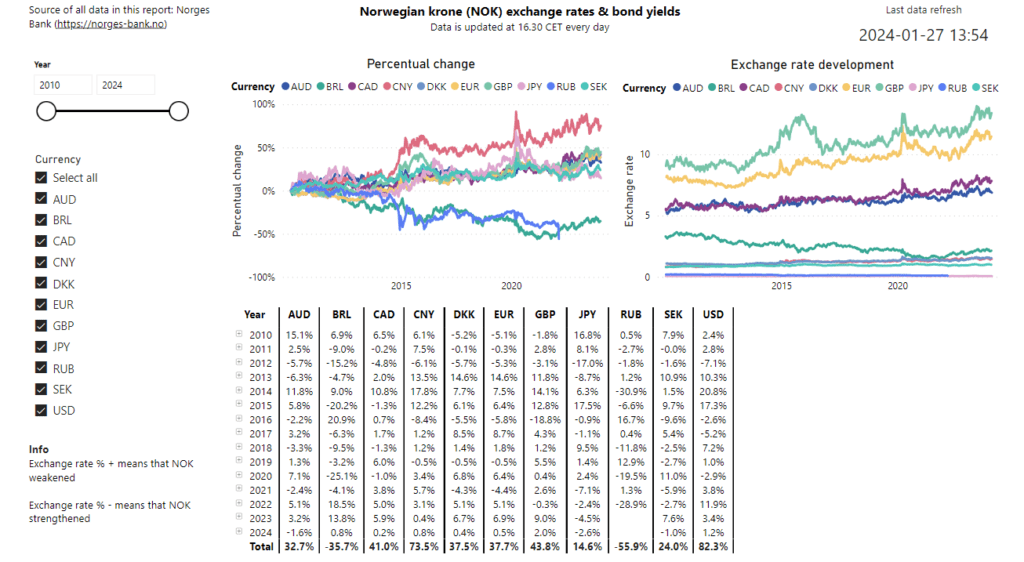

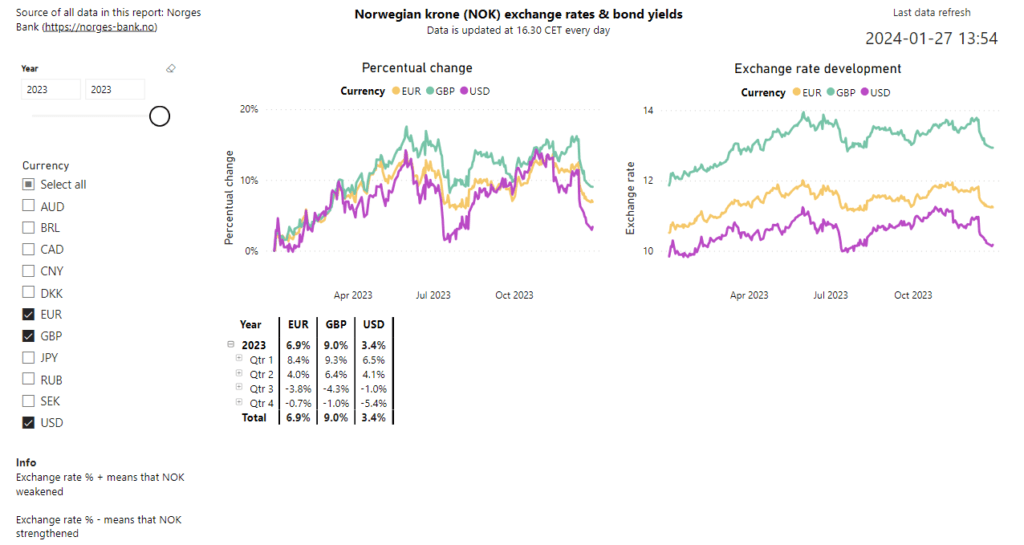

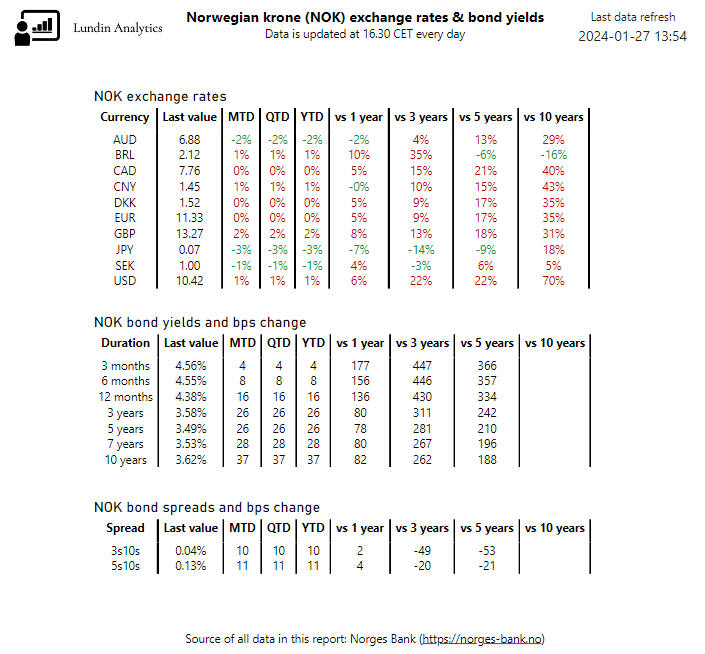

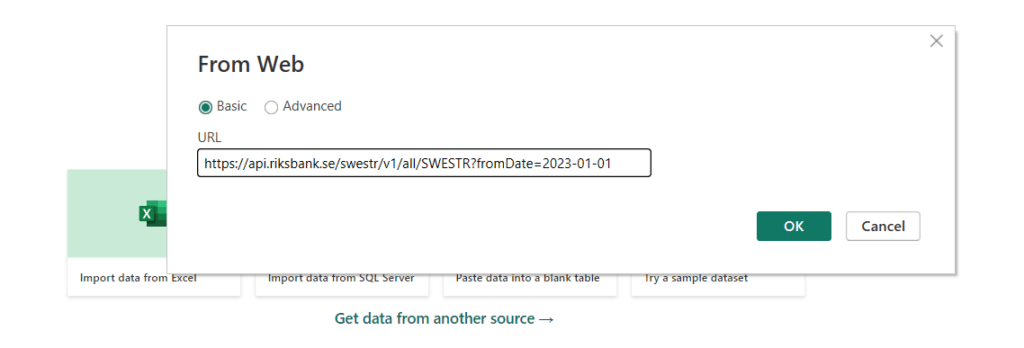

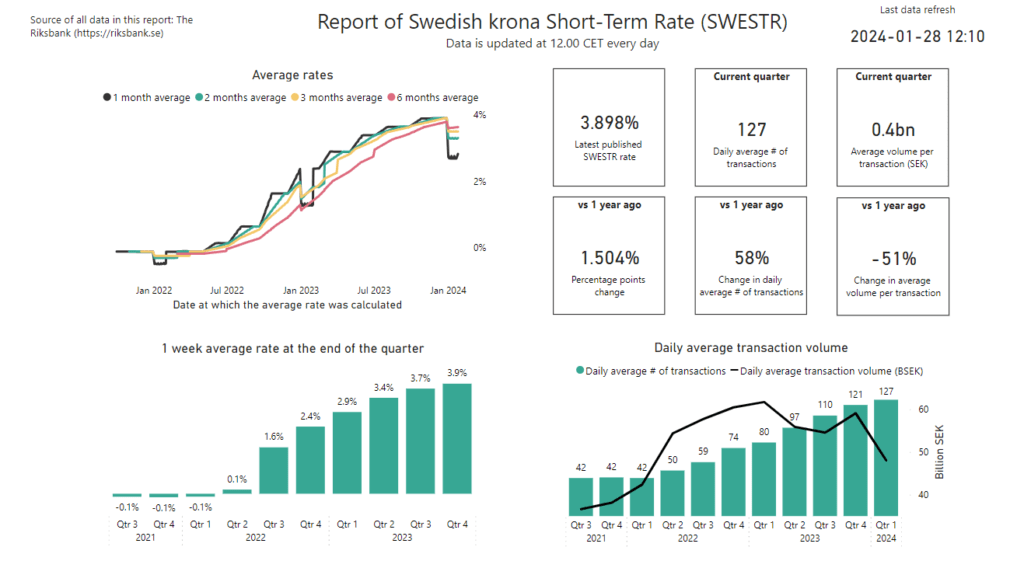

Our report, called Report of Swedish krona Short-Term Rate (SWESTR), reads the data directly to Power BI by using the REST API. Below is a picture of the report, available in our Portfolio, which we will now analyse further.

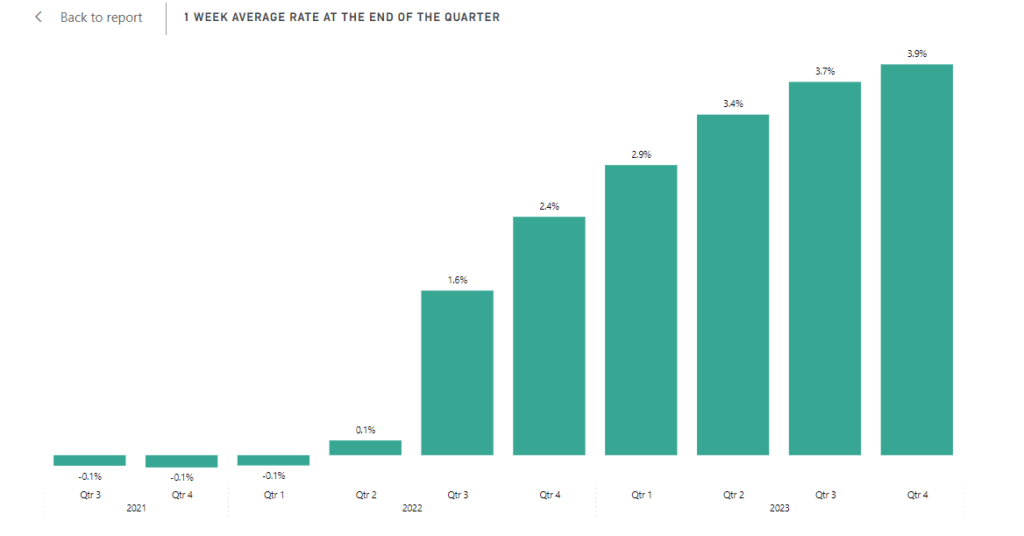

It can be seen that since the launch in Q3 2021, the rate has increased much. In order to reduce the noise of potentially low/high values, we present averages in our charts. For example the 1 week average rate, seen in the chart below, is the average rate for that week. The 1 week average, hence roughly also the SWESTR itself, has increased from -0.1% at the end of Q3 2021 to 3.9% at the end of Q4 2023. That is a dramatic increase of around 400 basis points (bps) in approximately 2 years.

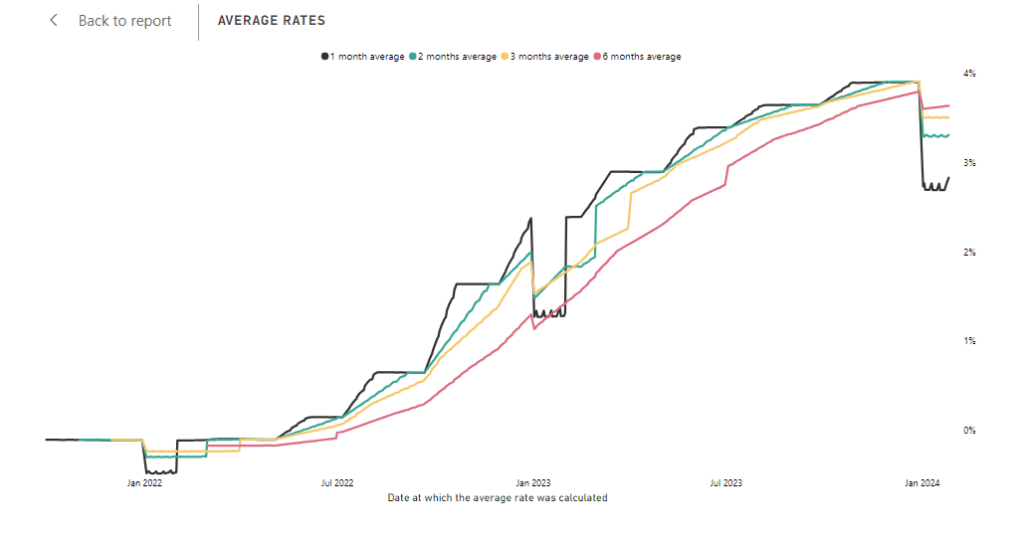

We also present the latest published SWESTR rate – at the time of writing this, it is 3.898%. That is 150 bps higher than 1 year ago, which is also a quite dramatic increase. Similarly to the 1 week average, we also present the averages calculated over longer time periods (1 – 6 monhts), which can be seen in the chart below. Naturally, the 6 months average will be “slower” and have less noise. It can be seen that all the four averages converged at the end of 2023, which means that the SWESTR value has been flat for some time.

SWESTR performance metrics

The volume, in terms of SEK per day, and the number of transactions per day, are also presented as can be seen in the chart below.

It seems that the SWESTR is gaining in popularity. It started out in Q3 2021 with on average 42 transactions per day. The average volume per day was 36.6 billion SEK. On average, this gives approximately 870 million SEK per transaction. The Riksbank then considers all of these transactions and calculates the rate to be used the next day for new transactions. In Q1 2024, there are so far 127 transactions per day – an increase of more than 200% since the launch. The average volume per day is 48.0 billion SEK, which is an increase of approximately 30% since the launch. However, this corresponds to on average 378 million SEK per transaction, which is a decrease of 57% since the launch. To summarise, the volume performance since launch is:

- Transactions per day: 42 to 127 (appr. +202%)

- Volume per day: 36.6 BSEK to 48.0 BSEK (appr. +31%)

- Volume per transaction: 870 MSEK to 378 MSEK (appr. -57%)

So, to summarise, many more but smaller transactions happen each day. The overall daily volume has substantially increased (+11.4 BSEK) as well.

Going back to the chart with the (average) rate at the end of each quarter, we see a massive rate increase in Q3 2022, which is approximately when central banks started to raise interest rates. The SWESTR went from 0.1 to 1.6% in just one quarter. The next quarter it increased by 0.8%, which is also a large increase. In the recent quarters, however, the rate is becoming more stable. In Q4 2023, it just increased by 0.2%. We can also note that the latest SWESTR (3.898%) is actually below or the same as the average of 3.9% at the end of 2023. So, if this continues for the rest of the quarter, we will see a “peak” of the rate in Q1 2024.

In this post, we have effectively used fundamental data analytics principles, to look at the SWESTR performance from many angles – latest rate (“price”), monetary volume and number of transactions. For example the monetary volume is important both for large and small financial actors and investors. If the volume is too large for an actor, the actor might not be confident that the SWESTR is an appropriate rate. On the other hand, if there is too little volume, large actors/investors might not want to use it for their transactions as it gives too little insight to their pricing case. Their transactions could also make up a large portion of the SWESTR volume which is not a desirable property of a reference rate. Finally, we have also reviewed several averages from 2021 to 2024, and the overall volume development since launch, to get some historical background as well.

More blog posts

Analysing the Swedish krona Short-Term Rate (SWESTR) Development using Power BI Read More »