On the development of the NOK exchange rates & bond yields in February 2024

Blog

On the development of the NOK exchange rates & bond yields in February 2024

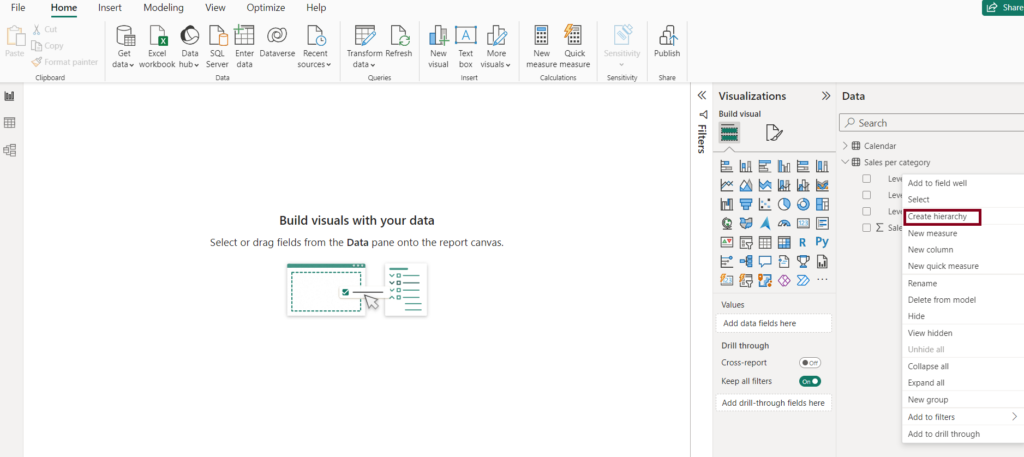

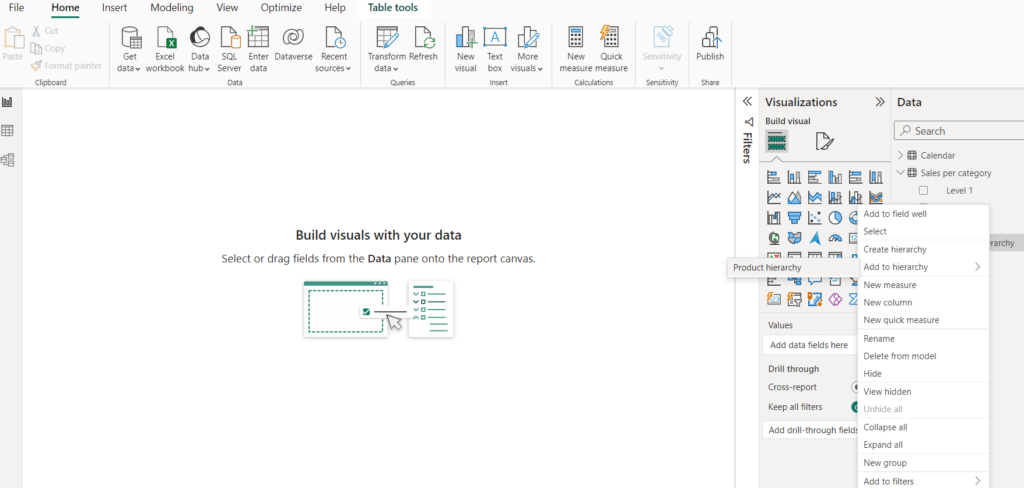

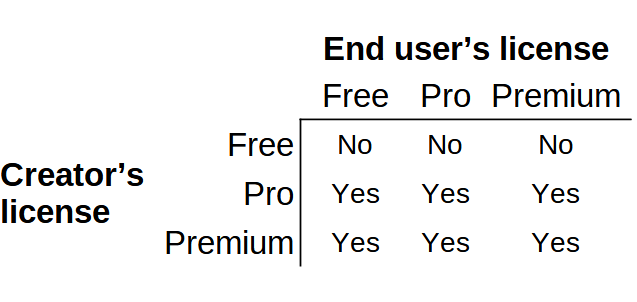

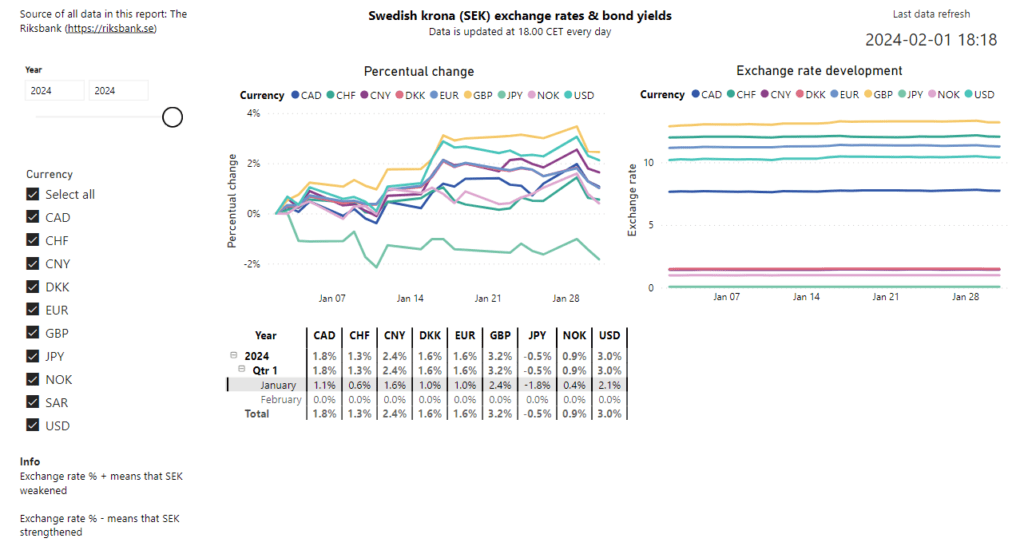

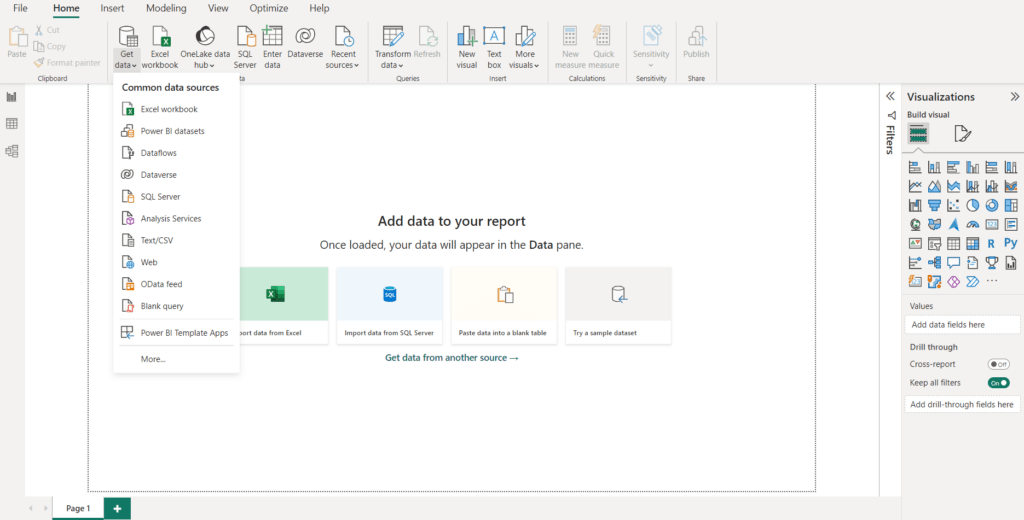

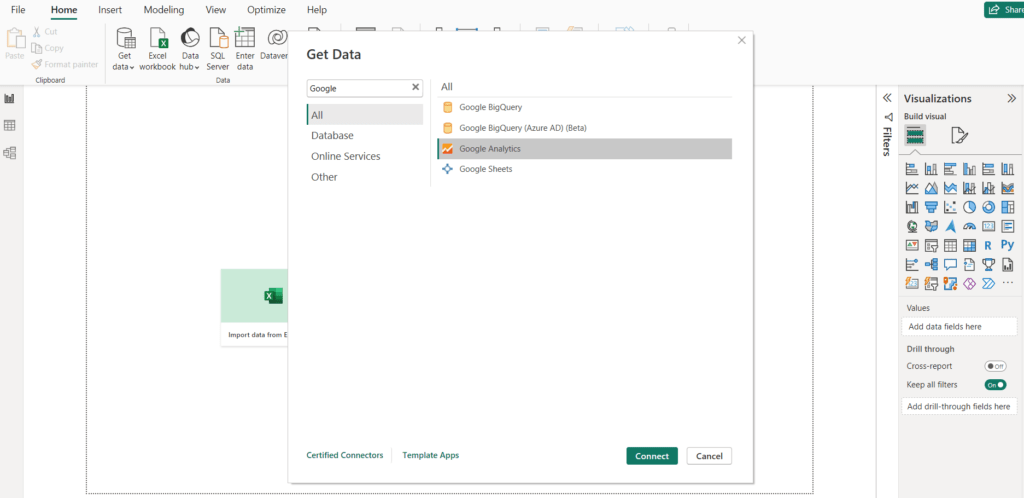

We analyse the development of the Norwegian krone (NOK) exchange rates and bond yields in February 2024. We do so by using a Power BI report that is available in our Portfolio. The source of all data is the Norwegian central bank – Norges Bank.

February 2024 overview

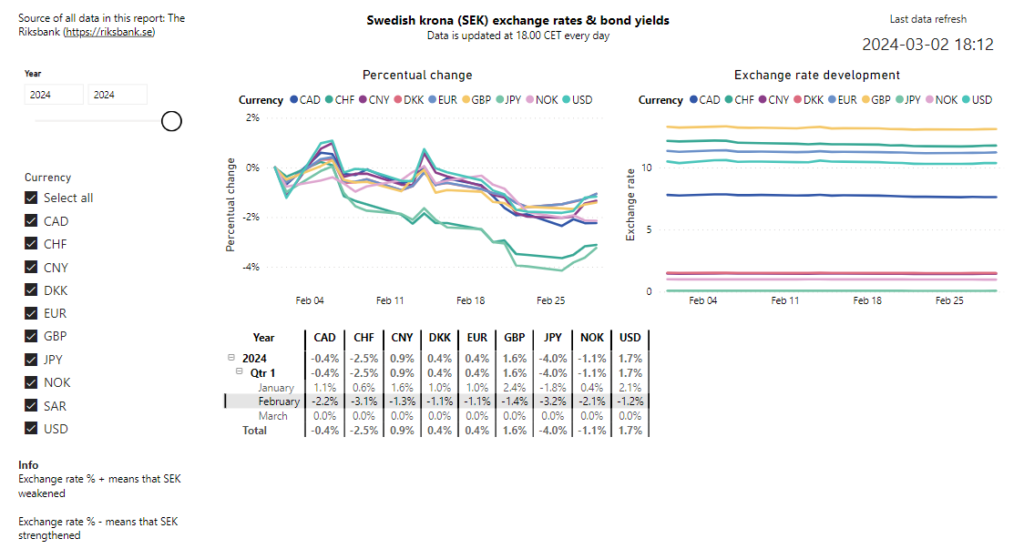

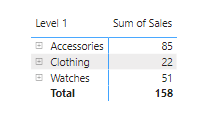

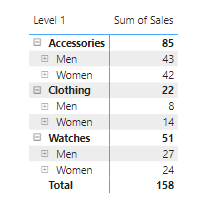

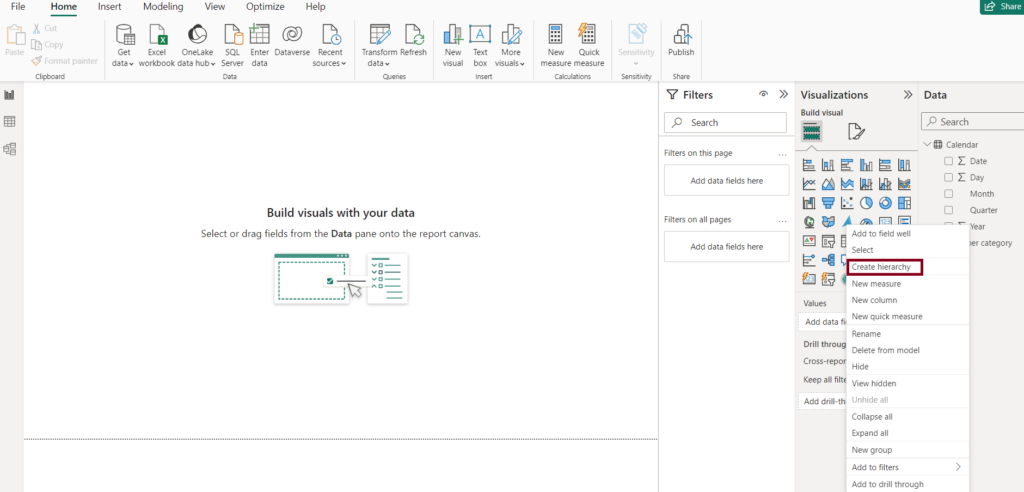

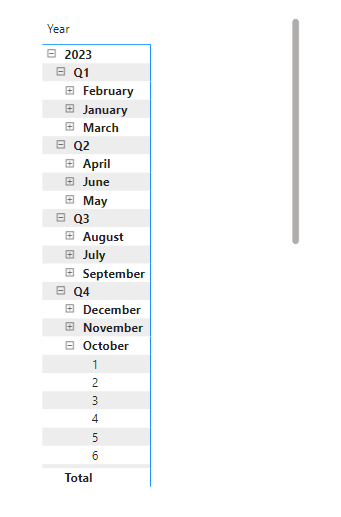

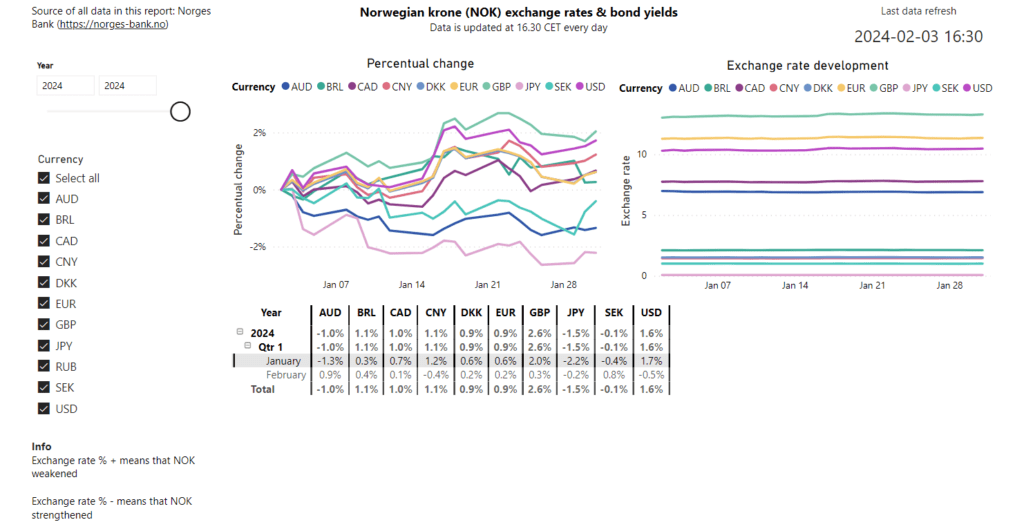

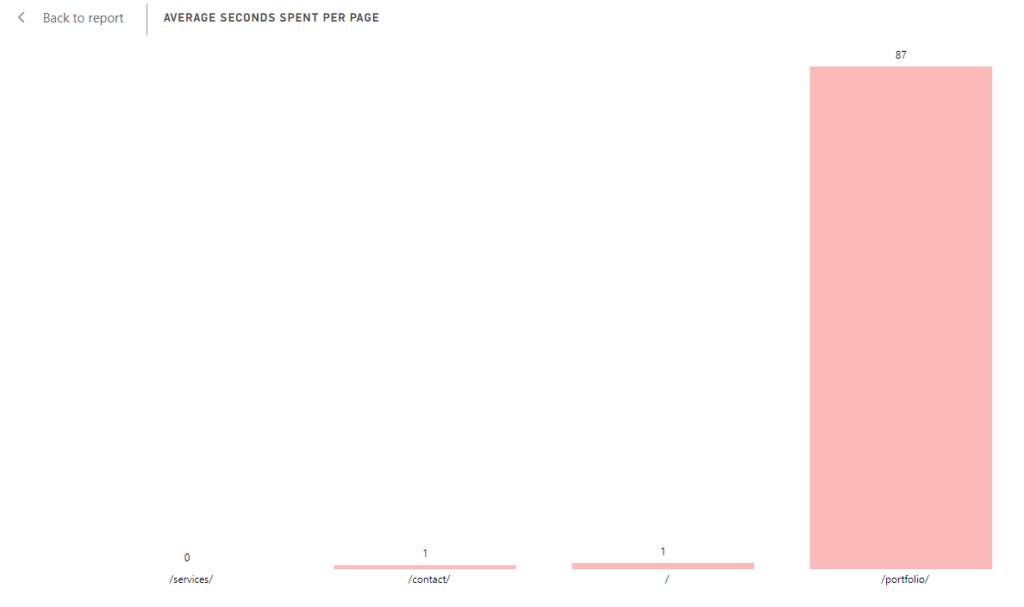

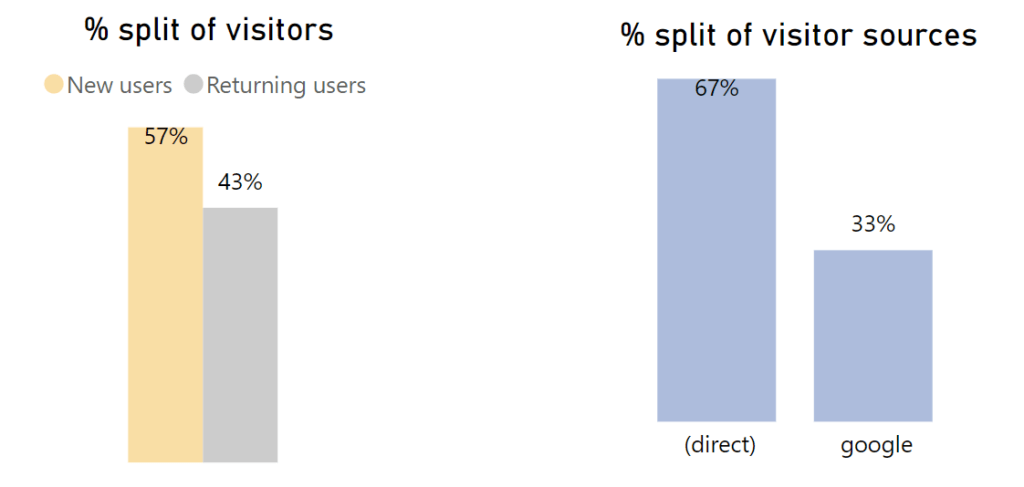

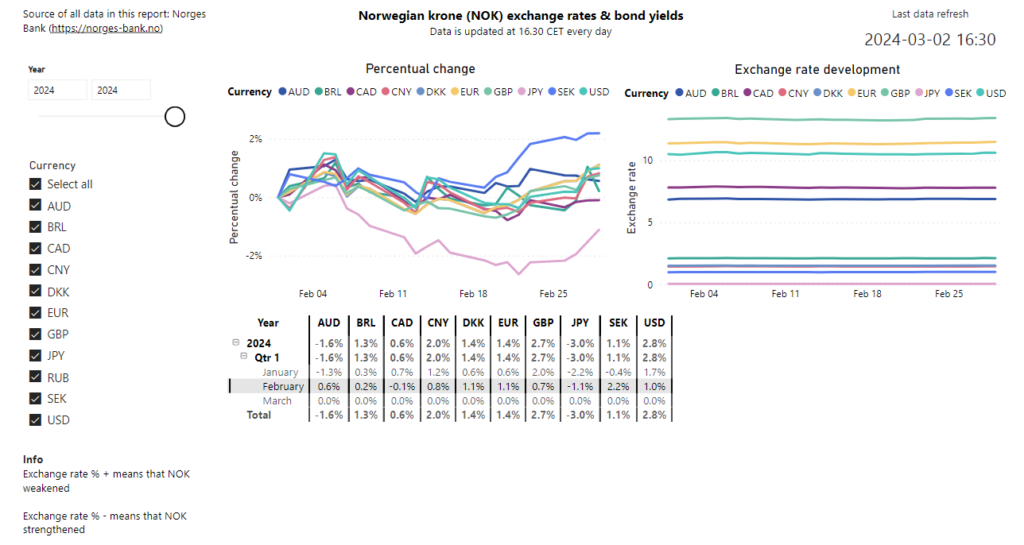

We start by going to this page and expanding the table so that the development in each month is visible. Then we click on February and consequently the whole page will be updated with February as a filter. This is a convenient way to filter without having explicit filters visually present in the report, which shows how dynamic Power BI is.

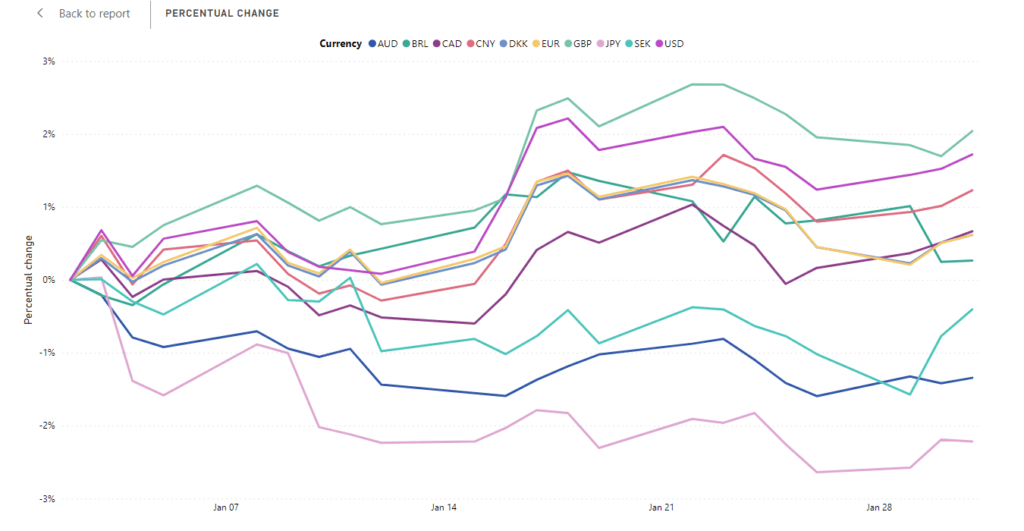

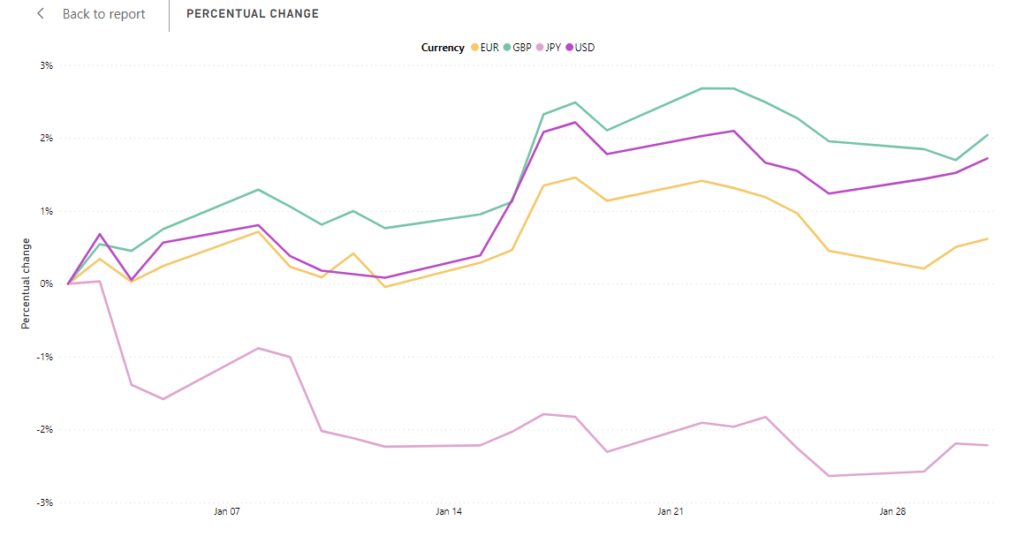

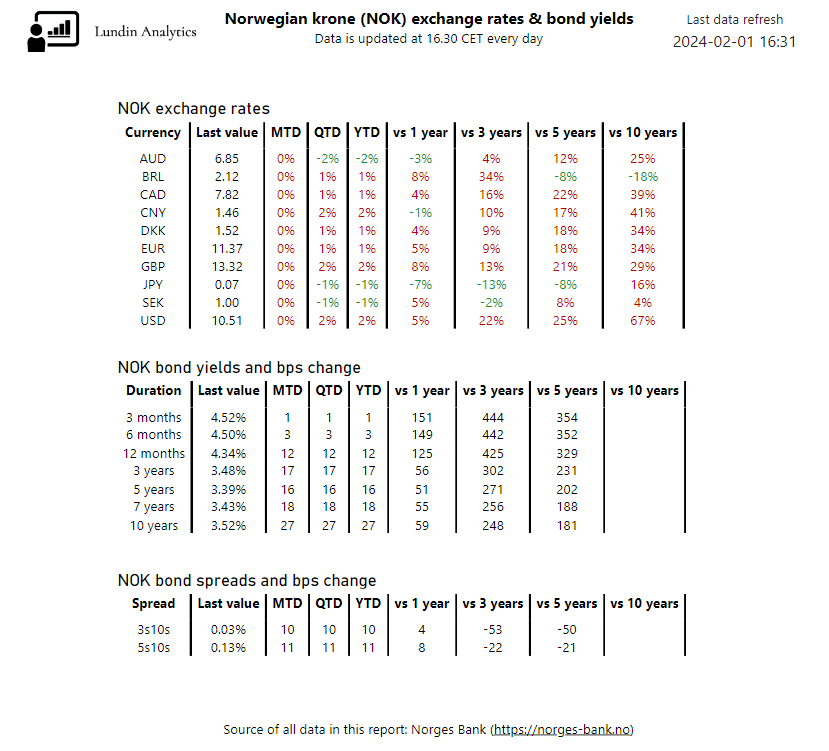

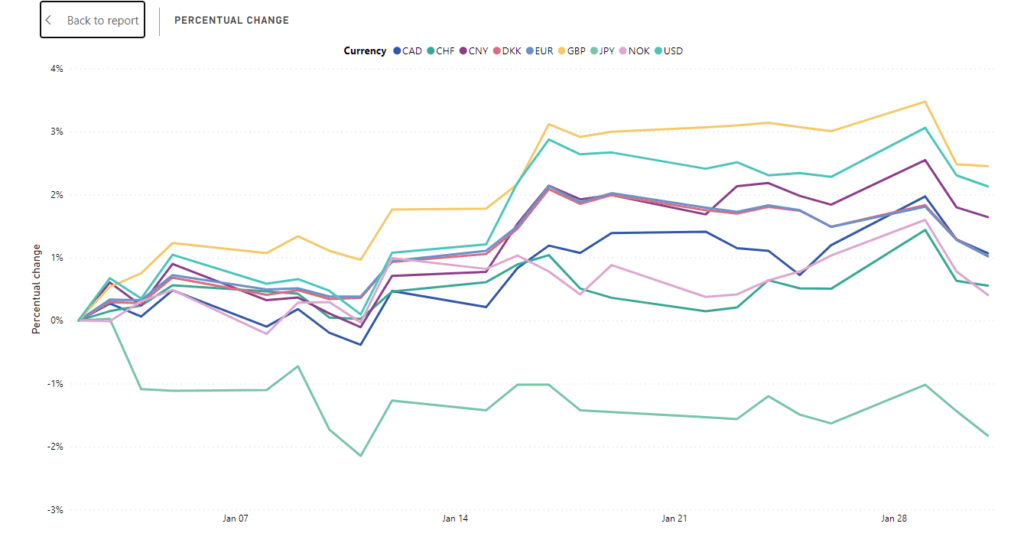

We then see that, in February, NOK strengthened against two currencies – Canadian dollar (CAD) and Japanese yen (JPY). Similarly to what we reported in our blog post on the January development, there were no dramatic changes of the NOK exchange rates in February. In February, all movements were in the range from -1% to 2%. It can be noted here that + means that NOK weakened, and – means that NOK strengthened. For example, if the EUR-NOK exchange rate goes from 10 to 11, that +1 change is a weakening of the NOK.

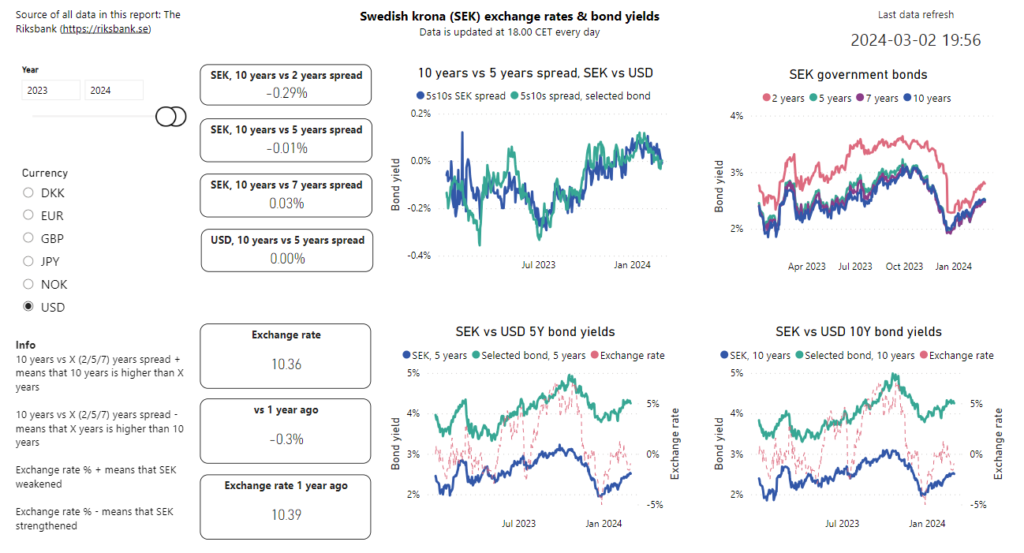

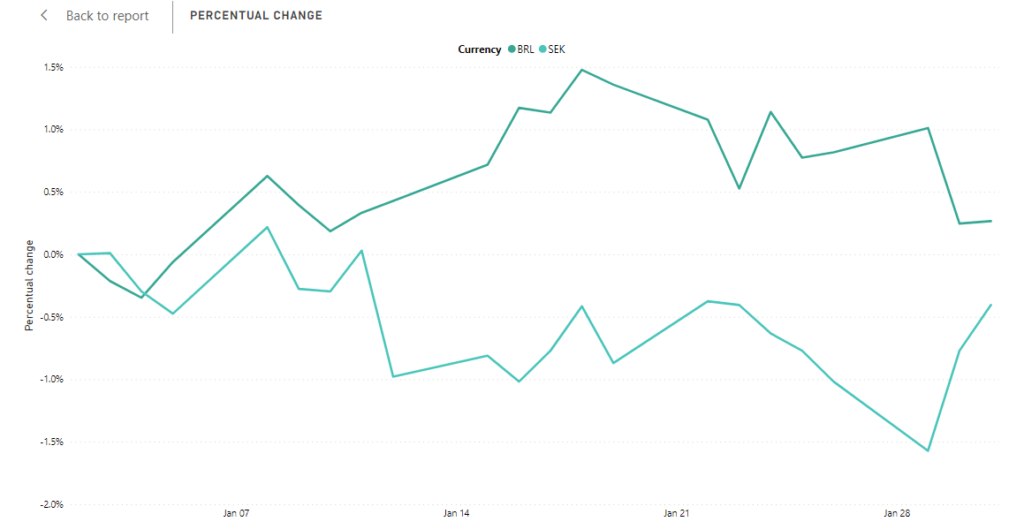

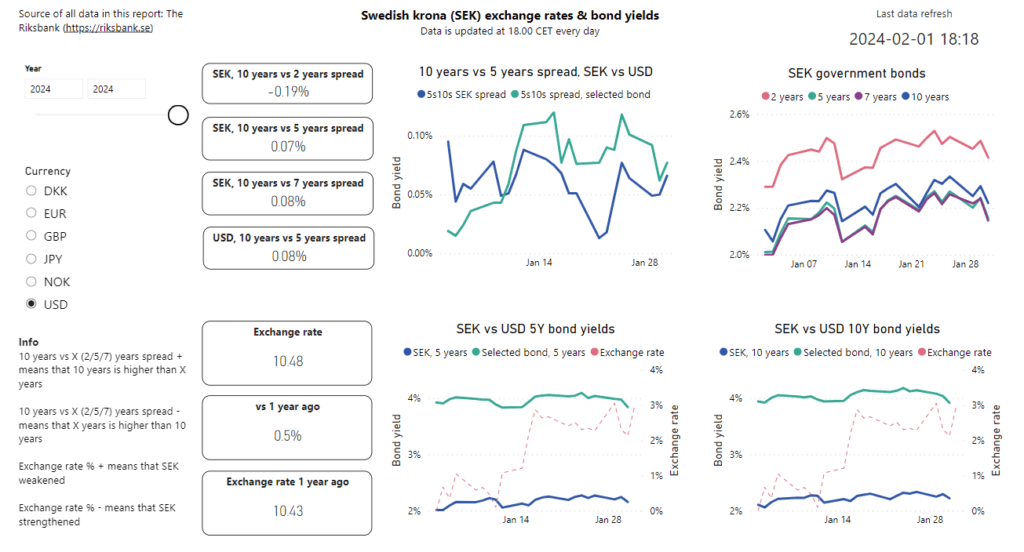

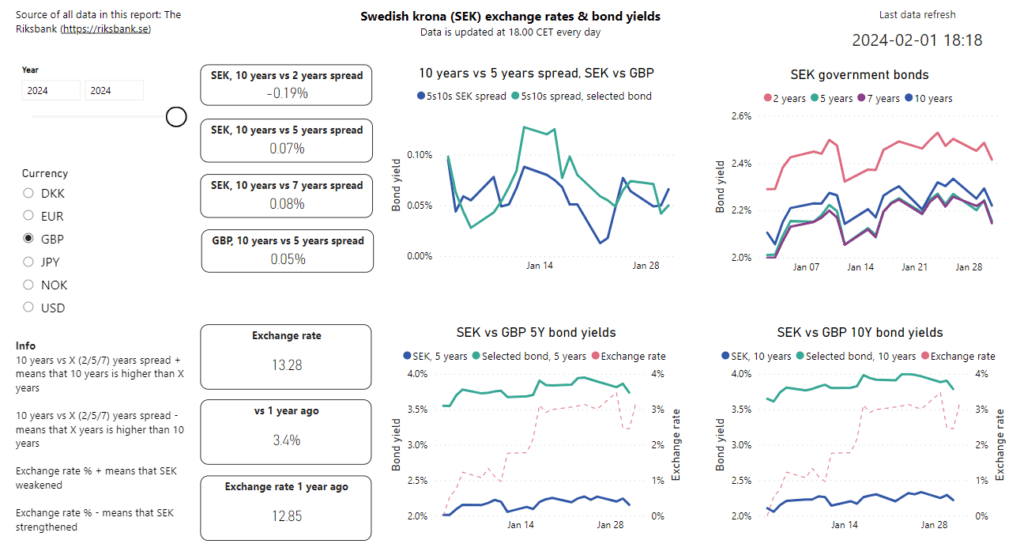

We note that NOK weakened the most – by 2.2% – against Swedish krona (SEK). We noted in our blog post on the SEK’s February development that SEK strengthened against many large currencies like CHF, EUR, GBP and USD. However, NOK weakened in February by 0.7% against GBP and by 1.0% against USD.

Year-to-date (YTD) in 2024, NOK has strengthened against Australian dollar (AUD) by 1.6% and against JPY by 3.0%. All movements YTD are in the range from -3% to 3%.

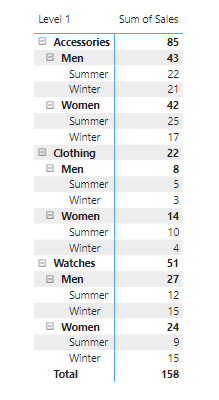

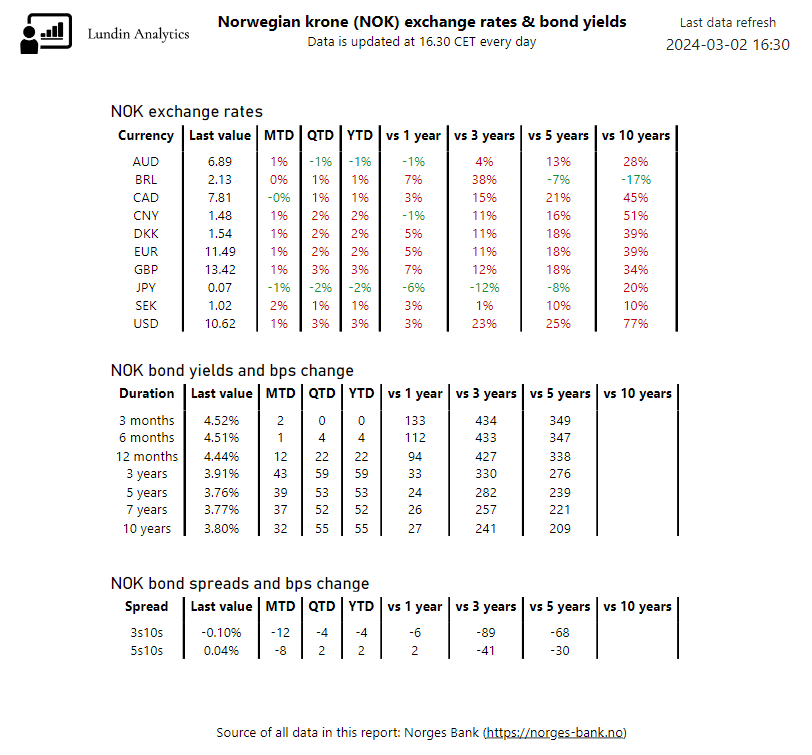

We then look at a summary page of the exchange rates in conjunction with NOK bond yields. First, we filter the page so that it only considers data before 1st of March 2024. We then see that there were large increases in the bond yields in February. For example, the 3 years bond yield increased by 43 bps to 3.91% and the 10 years yield increased by 32 bps to 3.80%. On the other hand, the bonds with short duration increased by smaller amounts. For example, the 6 months yield only increased by 4 bps to 4.51%, which is close to Norway’s current policy rate at 4.50%.

Year-to-date, the bond yields have increased significantly, and some examples are:

- 3 years: +59 bps to 3.91%

- 5 years: +53 bps to 3.76%

- 10 years: +55 bps to 3.80%

Finally, we review the bond spreads, which are the differences in yields between shorter-term bonds and longer-term bonds. For example, a common financial metric is to measure the difference in yield between a 5 years bond and a 10 years bond. We see that the 3s10s bond spread decreased by 12 bps to -0.10%, since the 3 years yield increased by 43 bps but the 10 years yield only increased by 32 bps.

Summary

In February 2024, there were no dramatic changes of the NOK exchange rates against major currencies like GBP, EUR, JPY and USD. The NOK weakened by 2.2% against SEK and by 1.1% against EUR. Meanwhile, the NOK strengthened by 1.1% against JPY.

With regards to the bond yields, there were large increases in the NOK bond yields in February. The bonds with short duration (3 – 12 months) barely moved but the ones with longer duration increased more, for example the 10 years yield increased by 32 bps in February.

More blog posts

On the development of the NOK exchange rates & bond yields in February 2024 Read More »