On the development of the SEK exchange rates & bond yields in Q3 2025

Blog

On the development of the SEK exchange rates & bond yields in Q3 2025

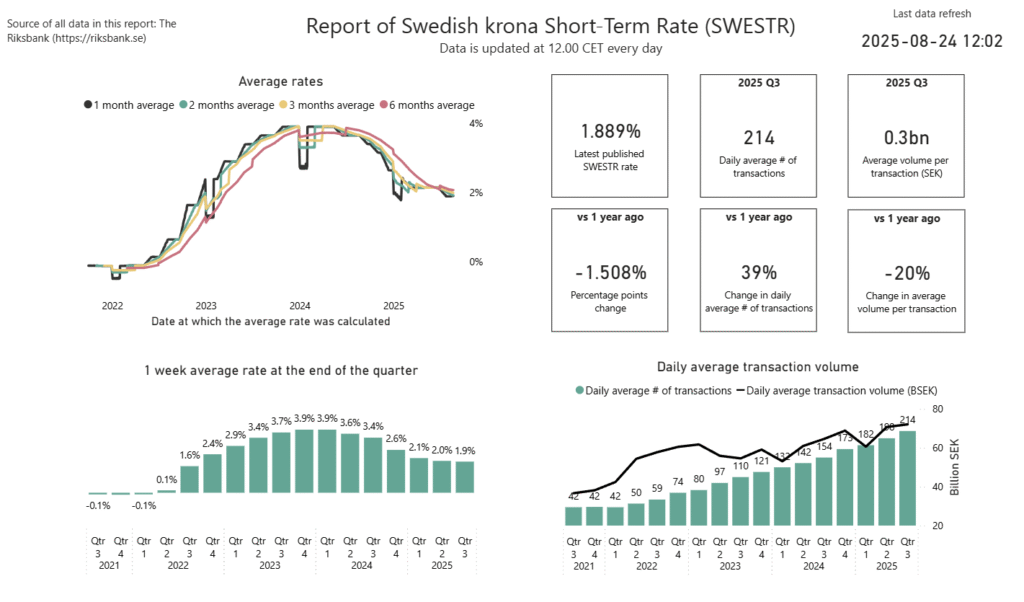

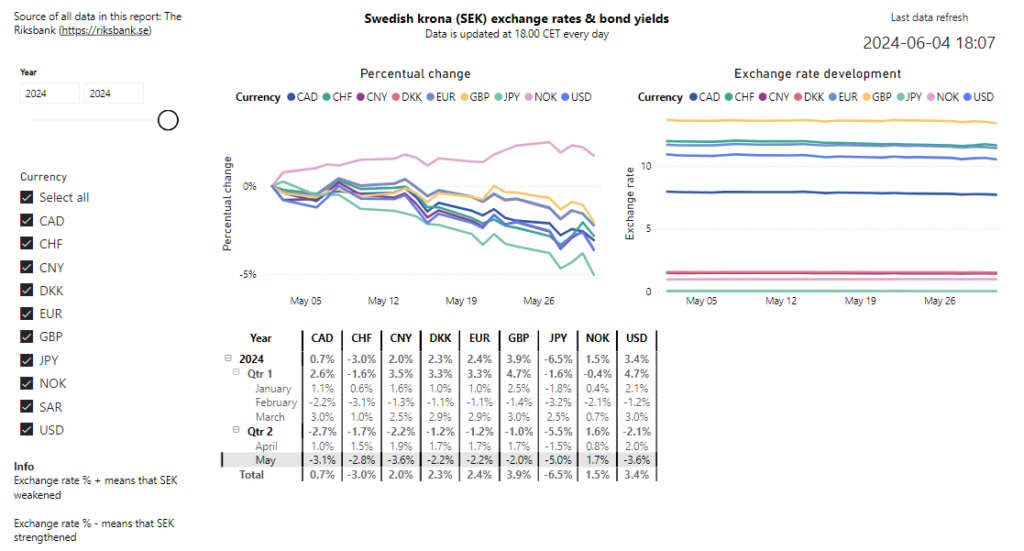

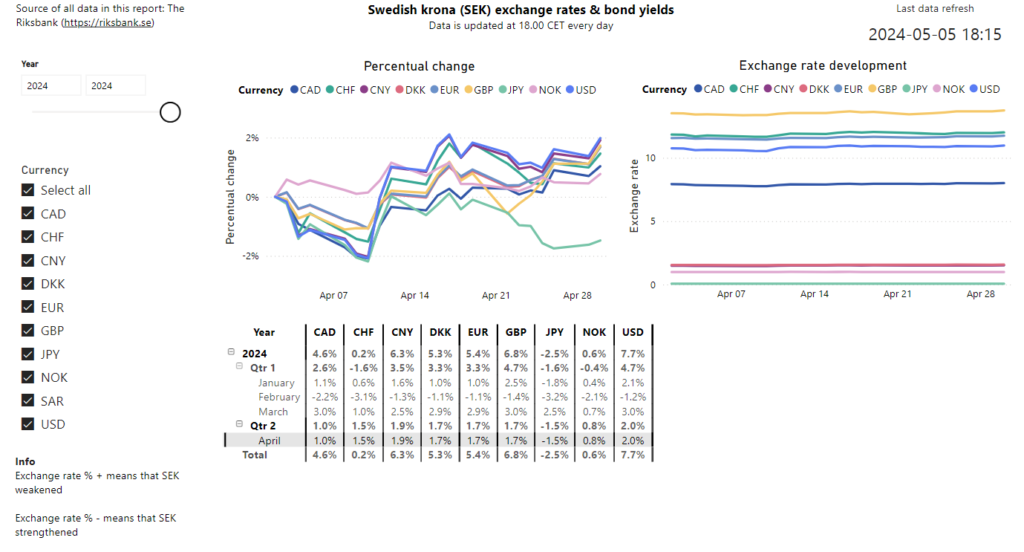

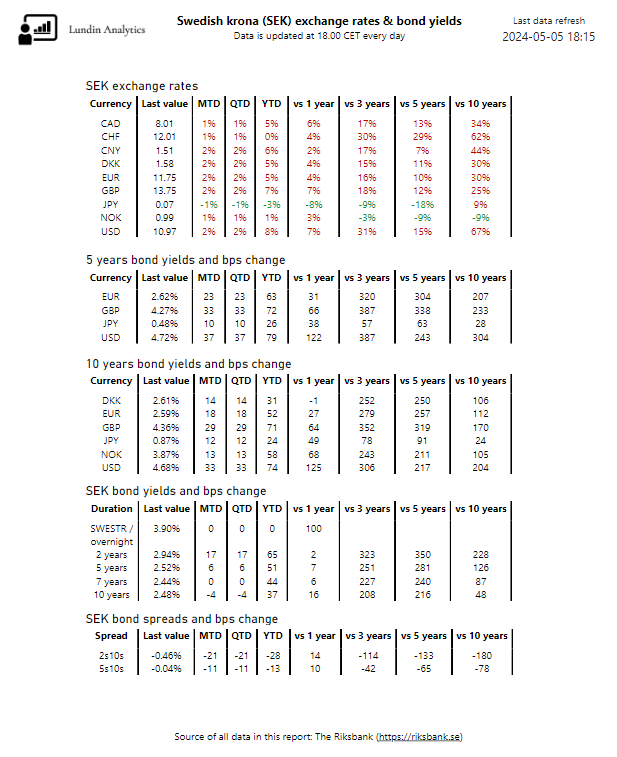

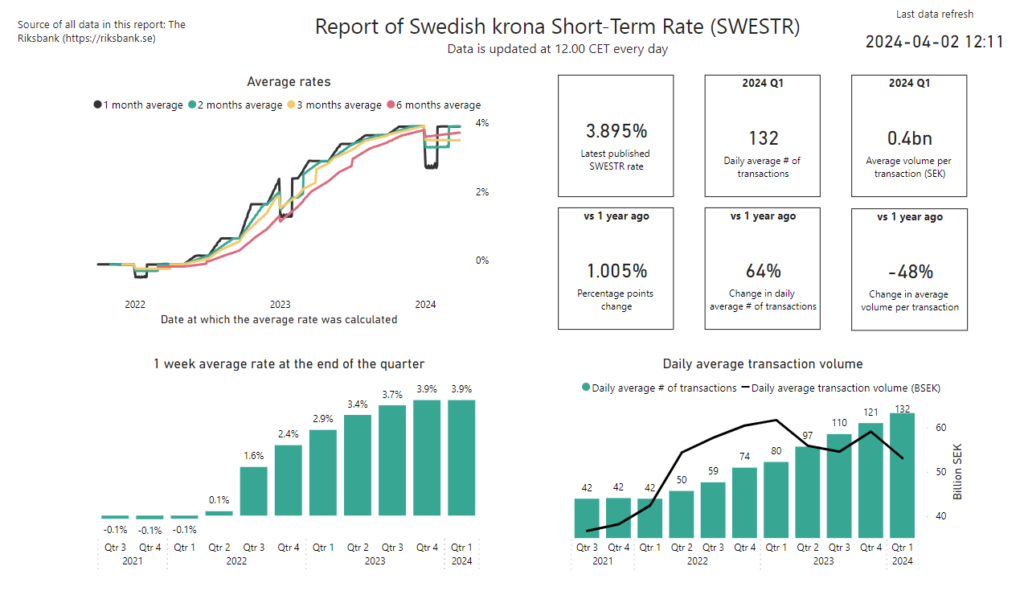

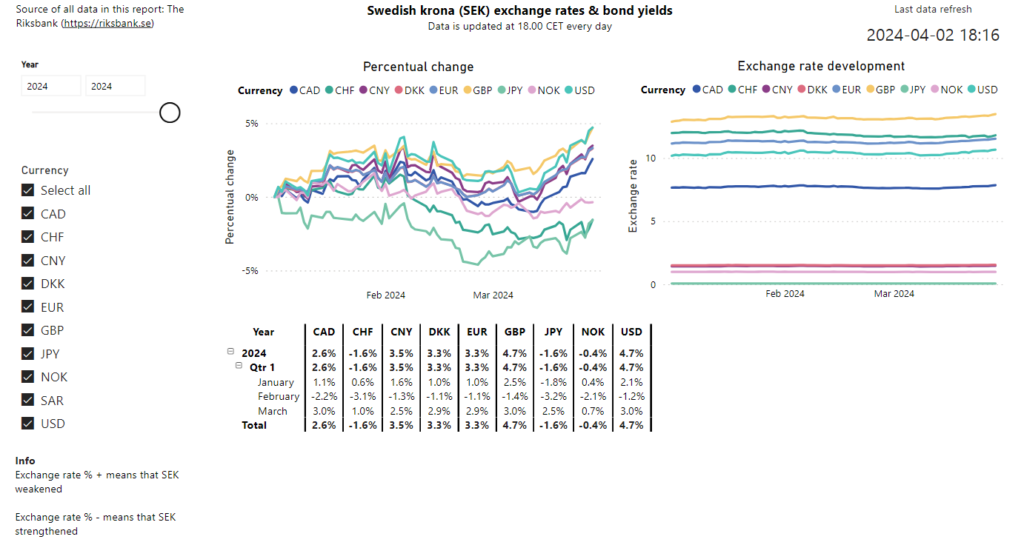

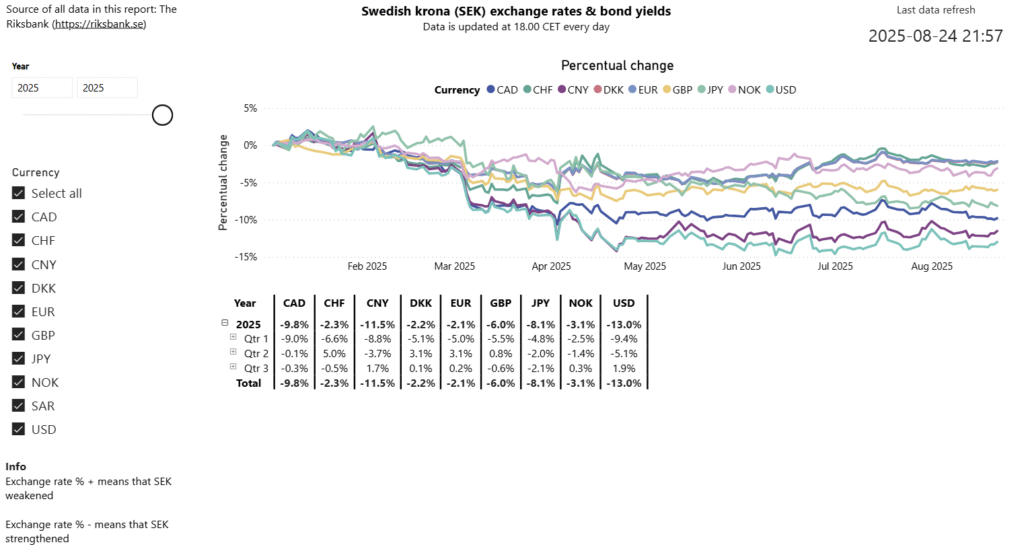

In this post, we analyse the development of the Swedish krona (SEK) exchange rates and bond yields in Q3 2025 and year-to-date (YTD) in 2025. We do the analysis with support from a Power BI report that we have developed, which is available in our Portfolio. The source of all the data in the report is the Swedish central bank – the Riksbank.

Q3 2025 exchange rates overview

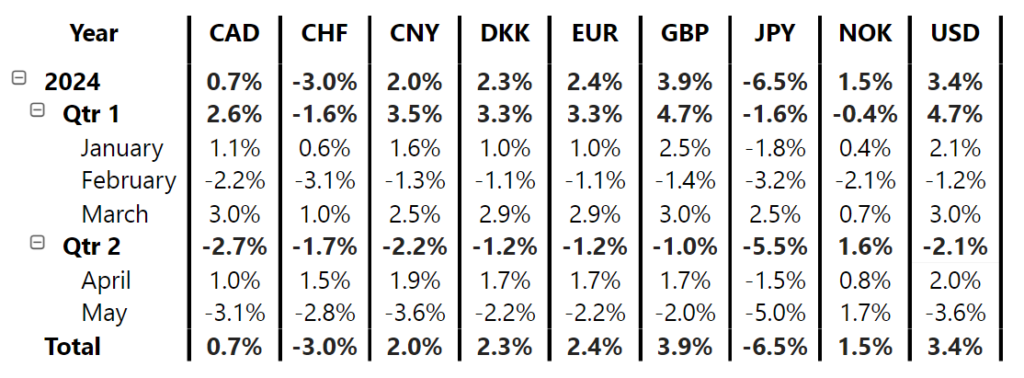

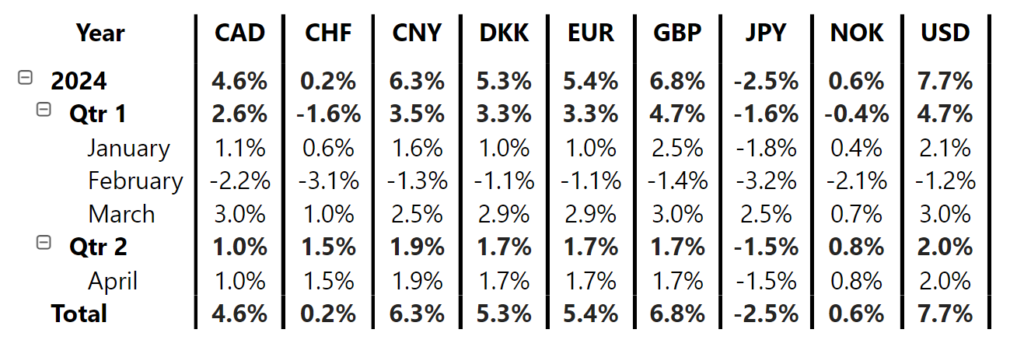

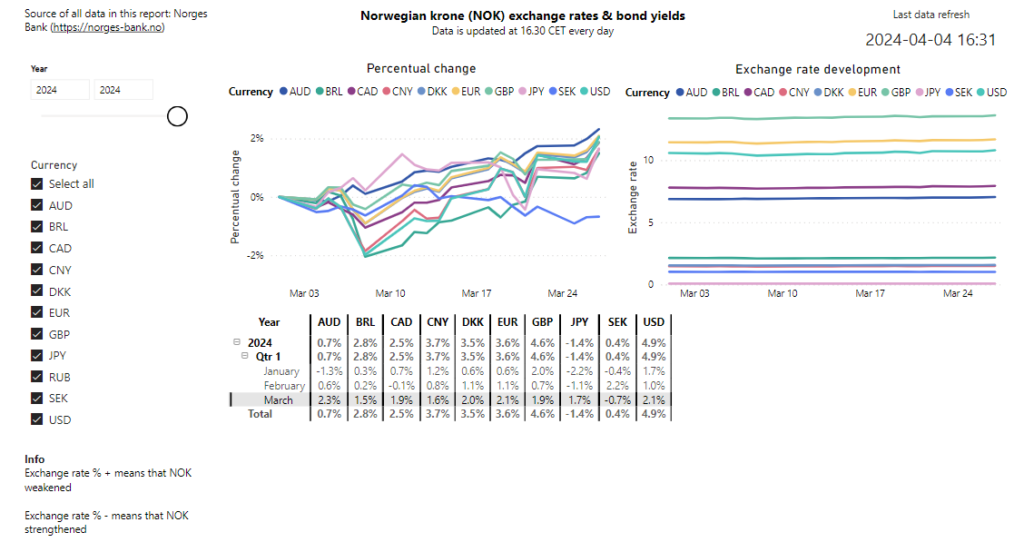

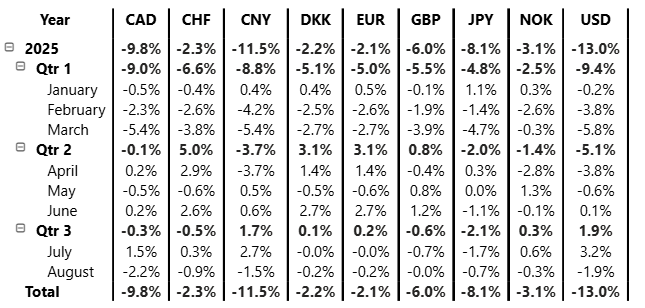

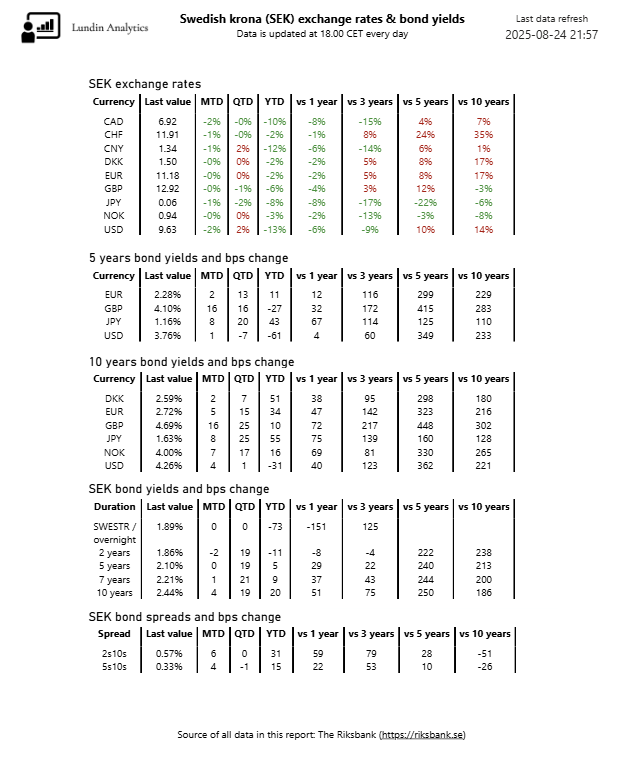

We use our Power BI report, go to the page below and expand the table so that the monthly development of the exchange rates is visible. We then change the filter so that only data from 2025 is presented. We see that SEK has strengthened against all the currencies available in the report in 2025. It has strengthened the most against USD and CNY – by 13.0% and 11.5% respectively.

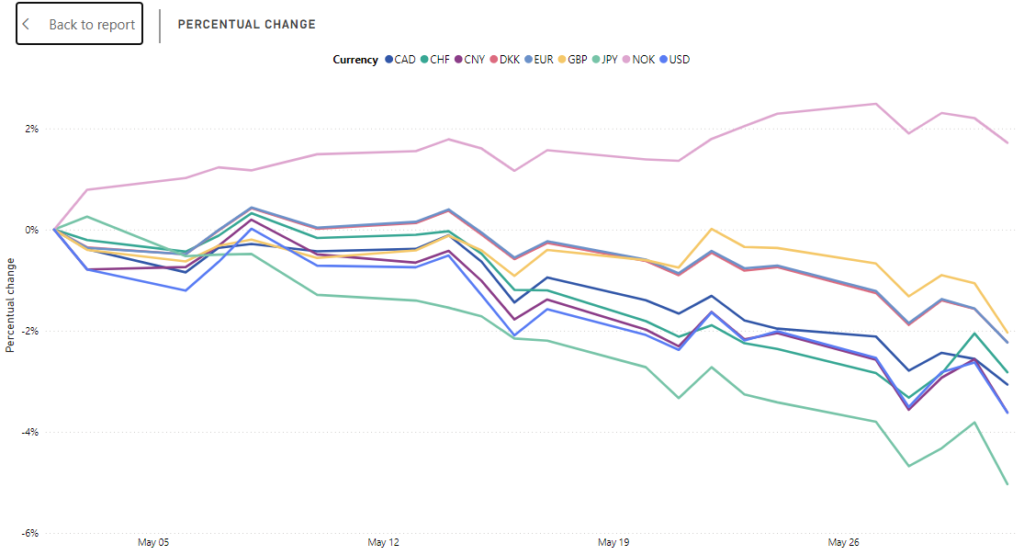

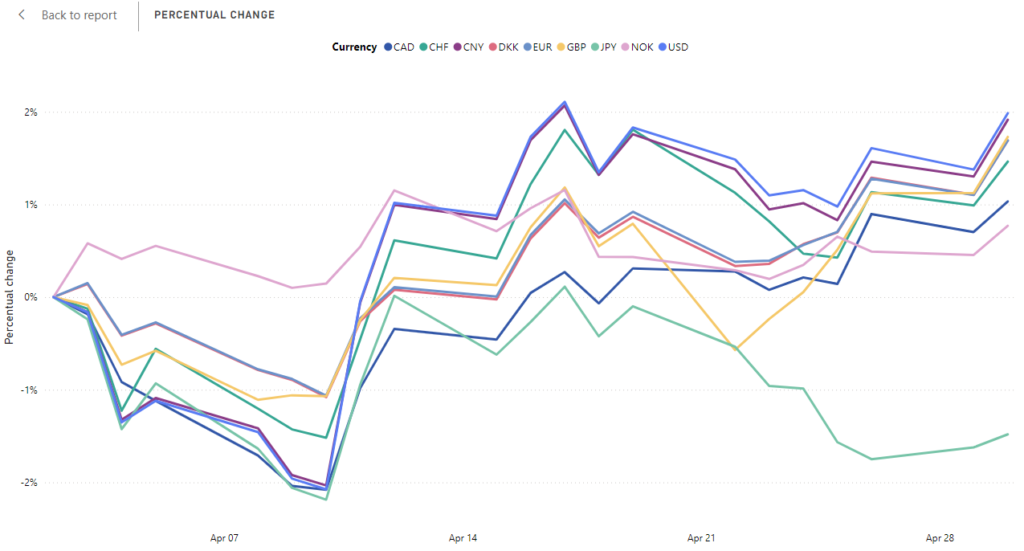

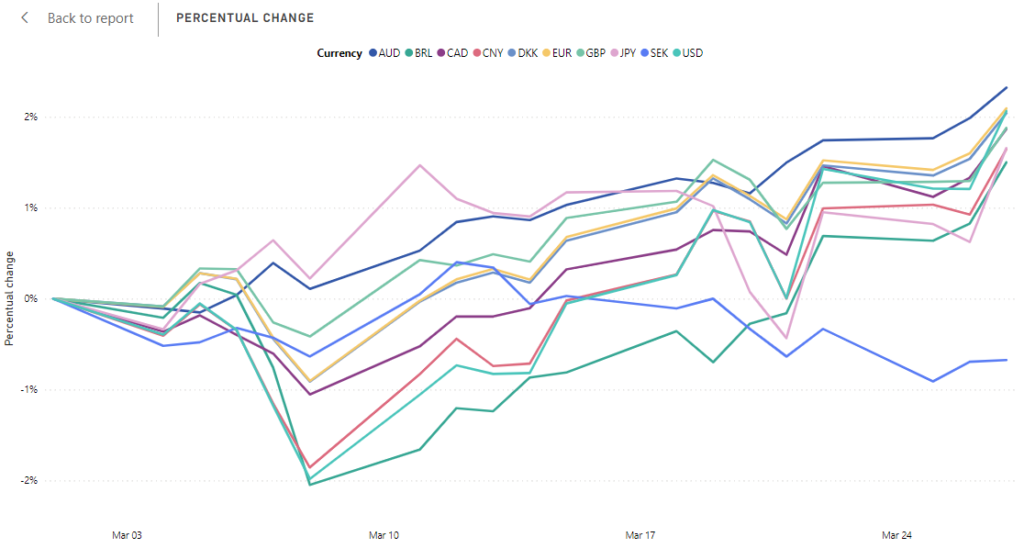

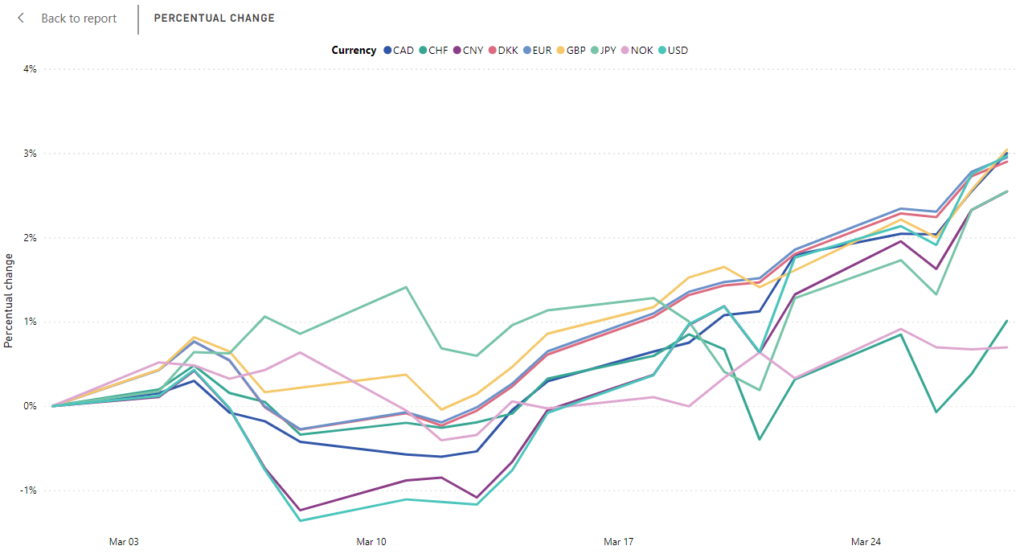

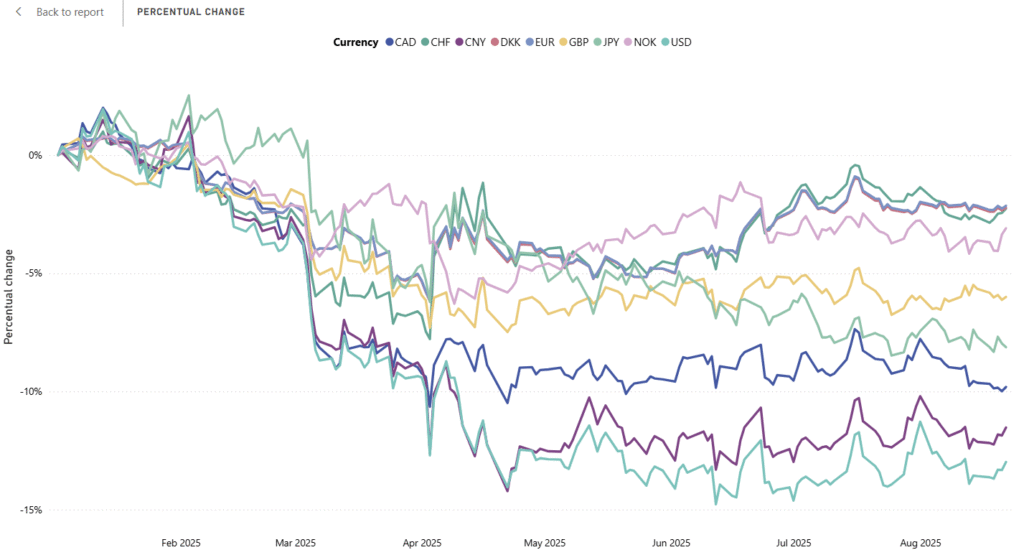

Zooming in on the chart with the percentual change, it looks like the picture below. We see that SEK primarily strengthened against the other currencies in the period between March and May. For the other periods of the year, it has been relatively flat.

Some notable changes from the table above are the following changes of the SEK exchange rates in 2025:

- Strengthening against US dollar (USD) by 13.0%

- Strengthening against Chinese yuan (CNY) by 11.5%

- Strengthening against Canadian dollar (CAD) by 9.8%

- Strengthening against Japanese yen (JPY) by 8.1%

2025 year-to-date overview

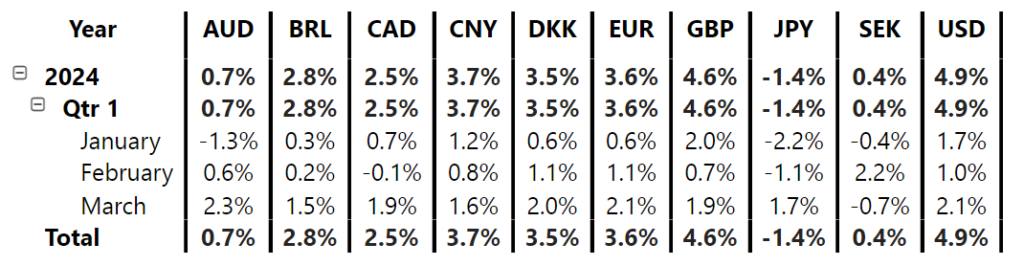

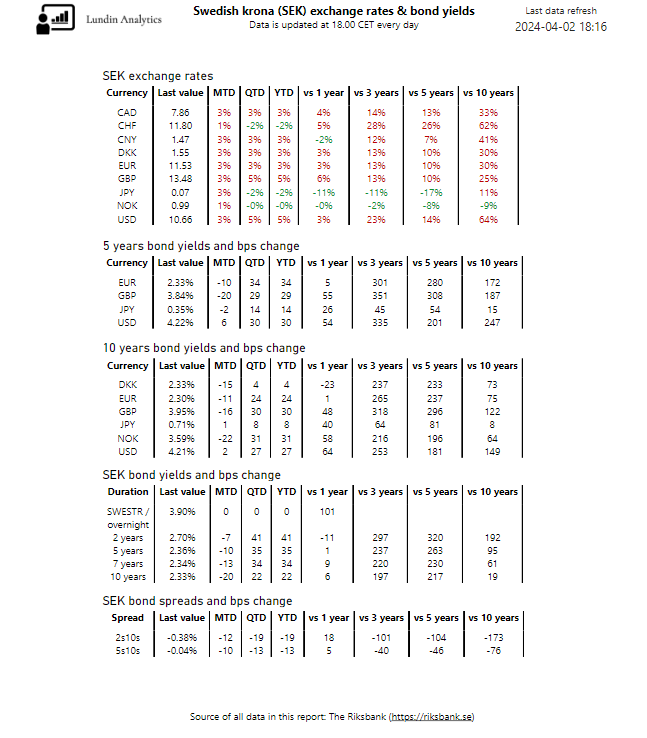

Zooming in on the table from the picture above, we can see the total development for August 2025 YTD. In 2025, SEK has strengthened against all currencies in the report.

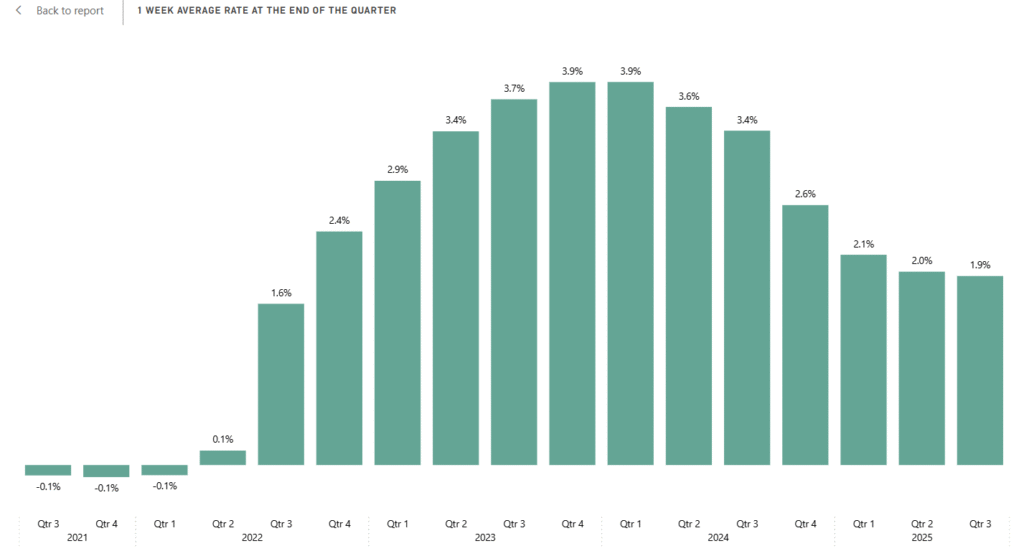

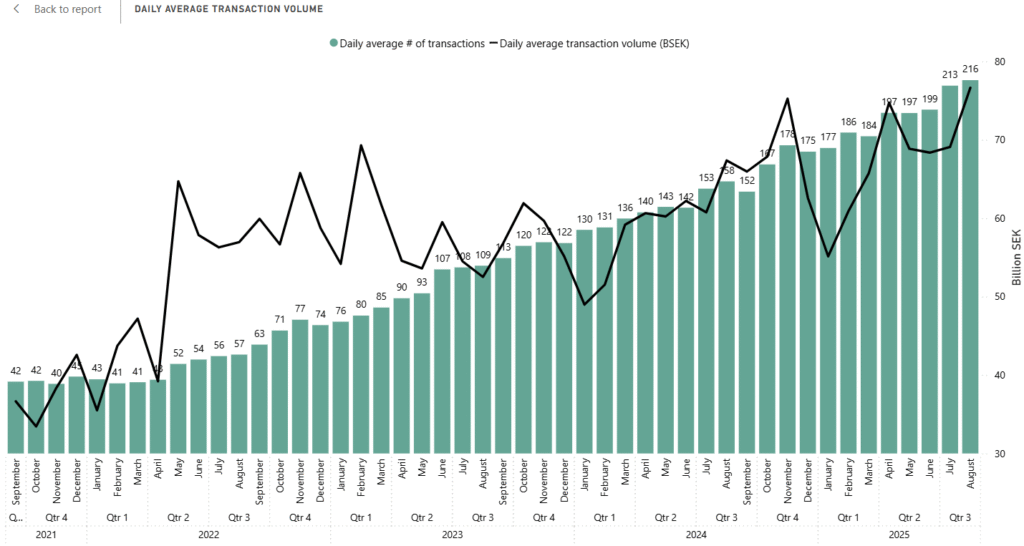

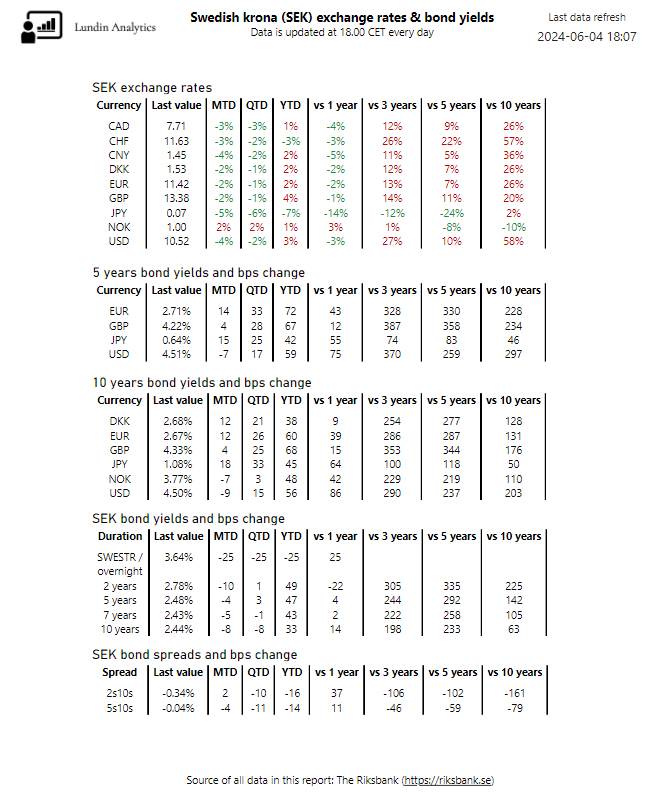

Bond yields in Q3 2025 and year-to-date

We also review the bond yields to explore possible reasons to the changes in the SEK exchange rates. From the picture below, we see that in Q3 (the QTD value), all the SEK bond yields increased slightly. The trend in 2025 for the SEK yields, is that the longer duration yields have increased while the shorter ones have increased by less or have decreased. This is the case not only for SEK but also for other bonds like GBP, EUR and USD. For GBP, the 5 years bond yield (5y) decreased by 27 bps YTD while the 10 years bond yield (10y) increased by 10 bps. Similarly, EUR 5y is +11 bps YTD and 10y is +34 bps. For USD, the 5y is -61 bps YTD and 10y is -31 bps.

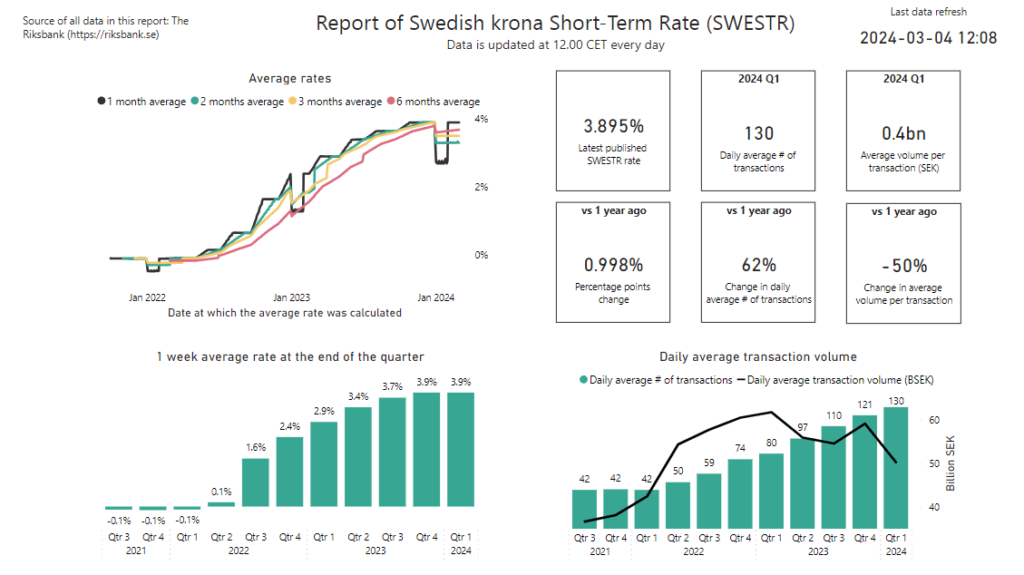

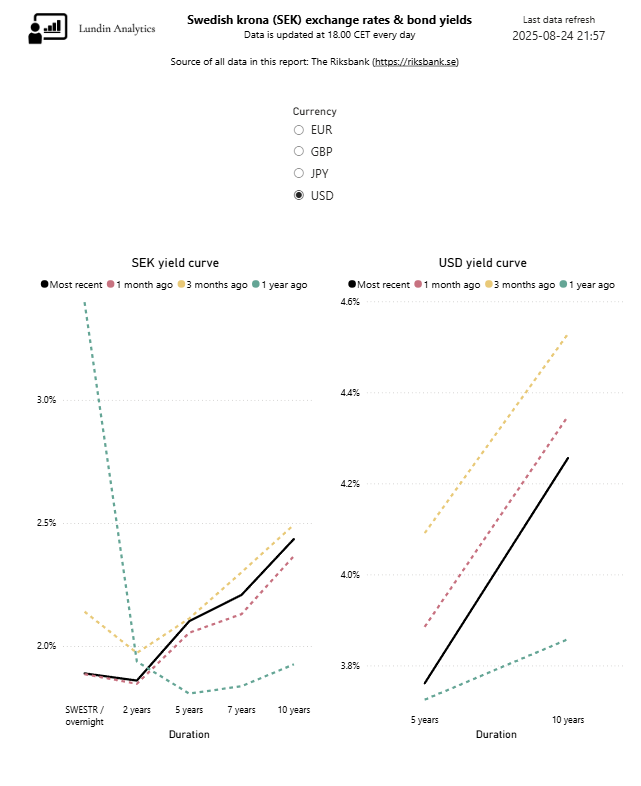

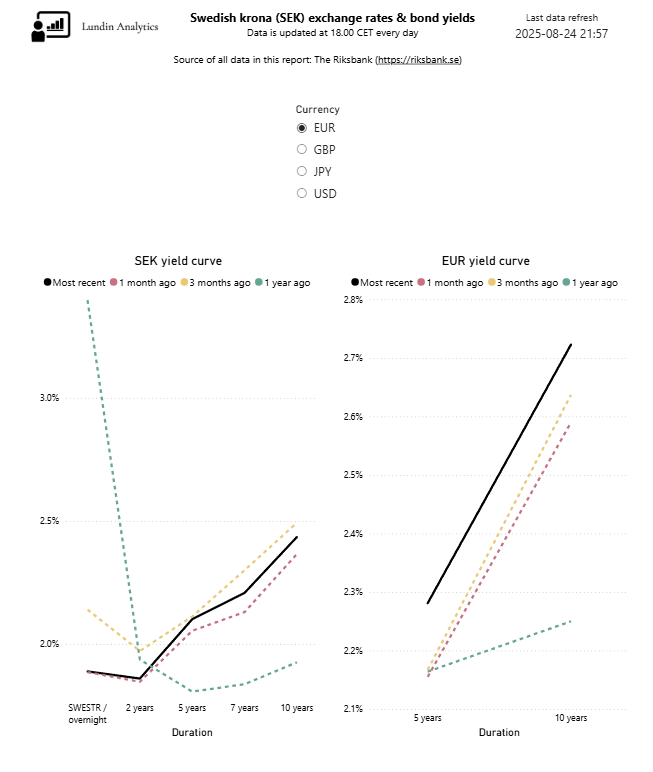

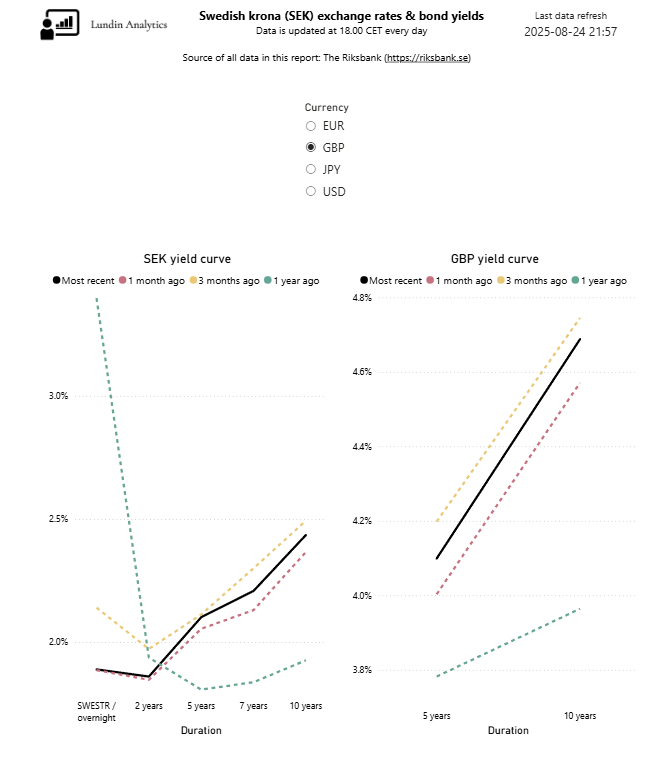

The same trend is visible also when comparing to 1 year ago. This is also seen on the yield curves which have changed their slopes. Here is an example of the SEK and USD yield curves. The SEK yield curve clearly goes from low yield on the short end and higher yield at the longer end. The USD yield curve has a steeper slope now compared to 1 year ago. Also the yield curves for EUR and GBP are presented below, and for which similar trends can be seen.

Summary

So far in 2025, SEK has strengthened against many large currencies like EUR, GBP and USD. It strengthened by 13.0% against USD, by 11.5% against CNY and by 8.1% against JPY. So far in Q3 2025, it has weakened against some currencies and overall small changes can be seen in any direction.

With regards to the SEK bond yields, there is a clear trend in 2025 that the yields with longer duration have increased faster than the ones with shorter duration. This trend is seen not only for SEK but for USD, EUR and GBP yields.

More blog posts

On the development of the SEK exchange rates & bond yields in Q3 2025 Read More »