Blog

On the development of the SEK exchange rates & bond yields in April 2024

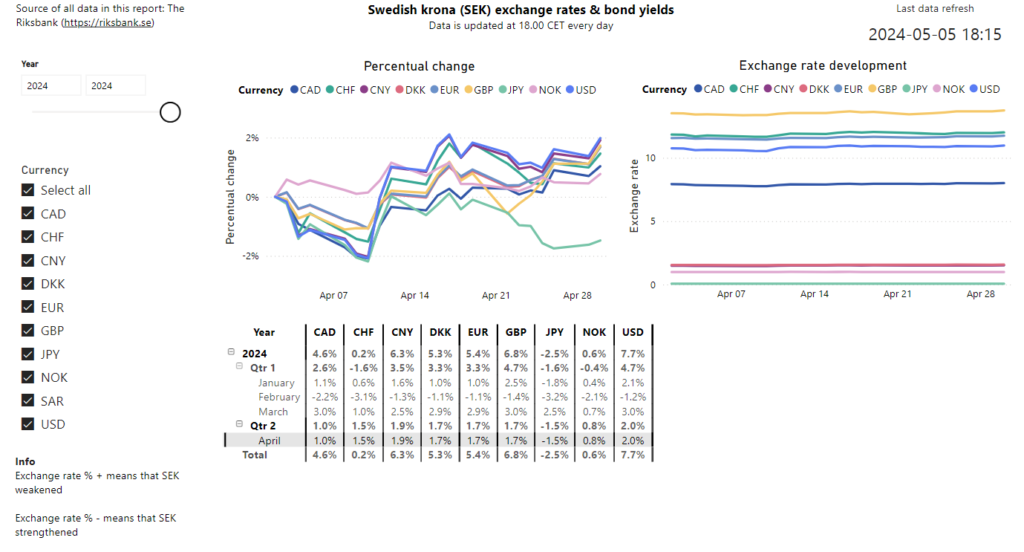

We analyse the development of the Swedish krona (SEK) exchange rates and bond yields in April 2024. We do the analysis with support from a Power BI report that we have developed, which is available in our Portfolio. The source of all the data in the report is the Swedish central bank – the Riksbank.

April 2024 overview

We start by filtering the report so that only data before the 1st of May 2024 is present in the report. We then go to the page below and expand the table so that the monthly development of the exchange rates is visible. We then click on April and consequently the page updates with April as a filter.

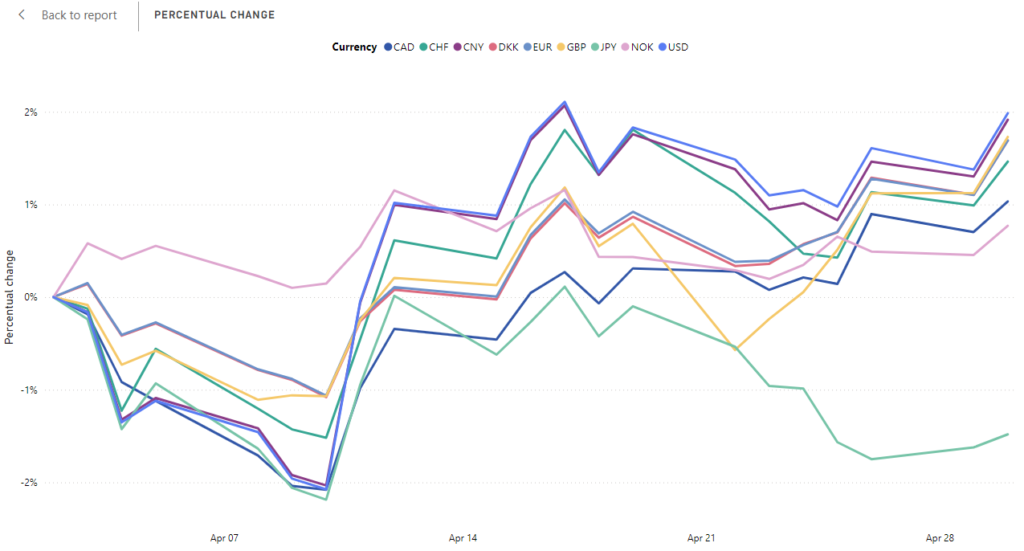

Zooming in on the chart with percentual change, it looks like the picture below. We see that SEK started the month by strengthening against all currencies except NOK in the report. However around the 10th of April, the SEK started to weaken against most currencies. It ended the month by weakening against all currencies in the report except JPY. As we see in the table above, all changes were in the range from -1.5% to 2.0%.

From the table above, we see some notable changes to the SEK exchange rates in April 2024, for example:

- Weakening against Swiss franc (CHF) by 1.5%

- Weakening against Chinese yuan (CNY) by 1.9%

- Weakening against Euro (EUR) by 1.7%

- Weakening against US dollar (USD) by 2.0%

- Strengthening against Japanese yen (JPY) by 1.5%

2024 year-to-date overview

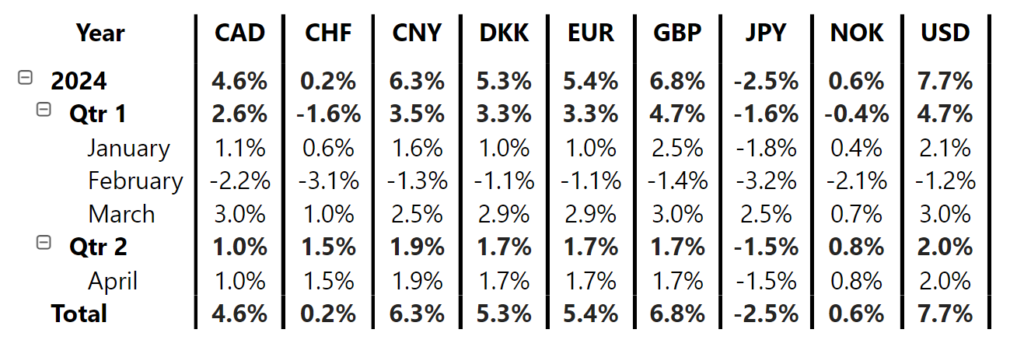

Zooming in on the table from the picture above, we can see the total development for 2024 year-to-date (YTD). In 2024, SEK has weakened against all currencies in the report except JPY.

Some notable changes to the SEK exchange rates in April 2024 YTD are:

- Weakening against CNY by 6.3%

- Weakening against Pound sterling (GBP) by 6.8%

- Weakening against EUR by 5.4%

- Weakening against USD by 7.7%

- Strengthening against JPY by 2.5%

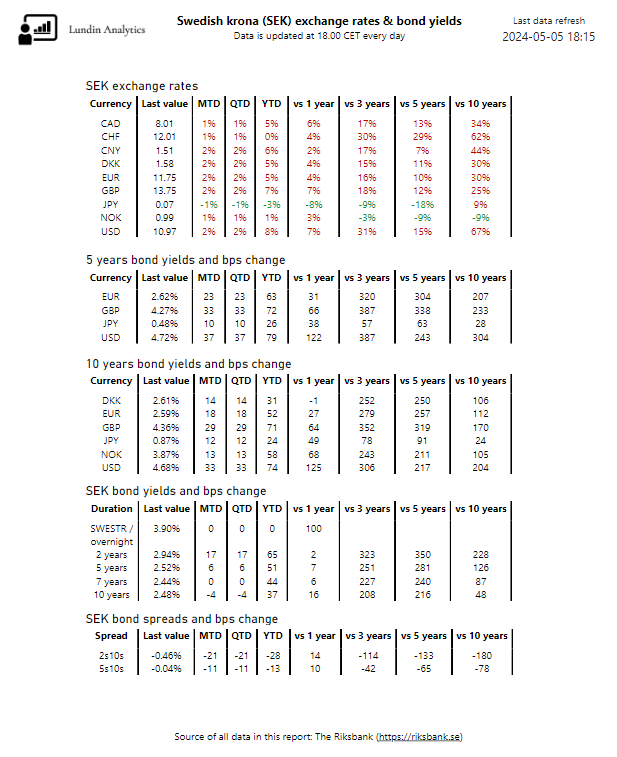

Bond yields

We also review the bond yields to explore possible reasons to the changes in the SEK exchange rates. From the picture below, we see that in April (the MTD value), all bond yields increased except the SEK 7 years and 10 years yields. This is aligned with the overall development in 2024, where the bond yields have all increased.

For example, the SEK 2 years yield decreased by 17 bps in April to 2.94%. So far in 2024, it has increased by 65 bps. Compared to 1 year ago, the 5 years yield is flat at just +2 bps, so it means the yield was decreasing in the end of 2023 but has now started to increase again in 2024.

With regards to the bond spreads, that is the difference between bonds with longer duration and bonds with shorter duration, there was some significant change in April, specifically for the 2s10s. Since the 2 years yield increased by 17 bps while the 10 years yield decreased by 4 bps, the spread decreased by -21 bps. Typically, there is a premium for bonds with longer duration like the 10 years bond, but following the -21 bps change, that is reversed and the 2 years bond now has a 46 bps premium against the 10 years equivalent.

In April, the GBP and USD 10 years yields increased by 29 bps respective 33 bps. The SEK 10 years yield actually decreased by 4 bps. This development can explain the weakening of the SEK against GBP (1.7%) and USD (2.0%) in April 2024.

Summary

In April, SEK weakened against many large currencies like EUR, GBP and USD. It weakened by 1.9% against CNY, 1.7% against EUR and by 2.0% against USD. In the time period of one month, this is not a dramatic change but it is still significant. The development in April is aligned with the overall development in 2024 where SEK has weakened against many currencies. For example, SEK has weakened against USD by 7.7% and against GBP by 6.8%. Meanwhile, it has strengthened against JPY by 2.5% and it is developing similarly to CHF – it has just weakened by 0.2% against CHF.

With regards to the SEK bond yields, they mostly increased in April. This is aligned with the overall development in 2024. For example, the 2 years yield decreased by 17 bps in April to reach 2.94% and so far in 2024 it has increased by 65 bps. However, compared to 1 year ago, it is just 2 bps higher now.

In April, the 5 years and 10 years yields in other currencies, for example in GBP and USD, increased more than SEK. This can explain the SEK weakening in April 2024.