Reading monetary policy data from the Riksbank via REST API

Blog

Reading monetary policy data from the Riksbank via REST API

In this post, we analyse monetary policy data that is provided by the Swedish central bank – the Riksbank. We read the data by using their REST API. We do the analysis with support from a Power BI report, which we have developed and which is available in our Portfolio.

For more information on the monetary policy data, please see the Swedish central bank’s website.

Overview of monetary policy data

Monetary policy data includes data for KPIs like Consumer Price Index (CPI), Consumer Price Index With Fixed Interest Rate (CPIF), GDP growth and unemployment rate. The Riksbank provides this data for Sweden specifically.

The data is structured with a few updates per year, each happening around the Riksbank’s so called “policy rounds”. An example would be policy round 2025:1, which is the first policy round of 2025. The data contains both historical numbers and forecasts.

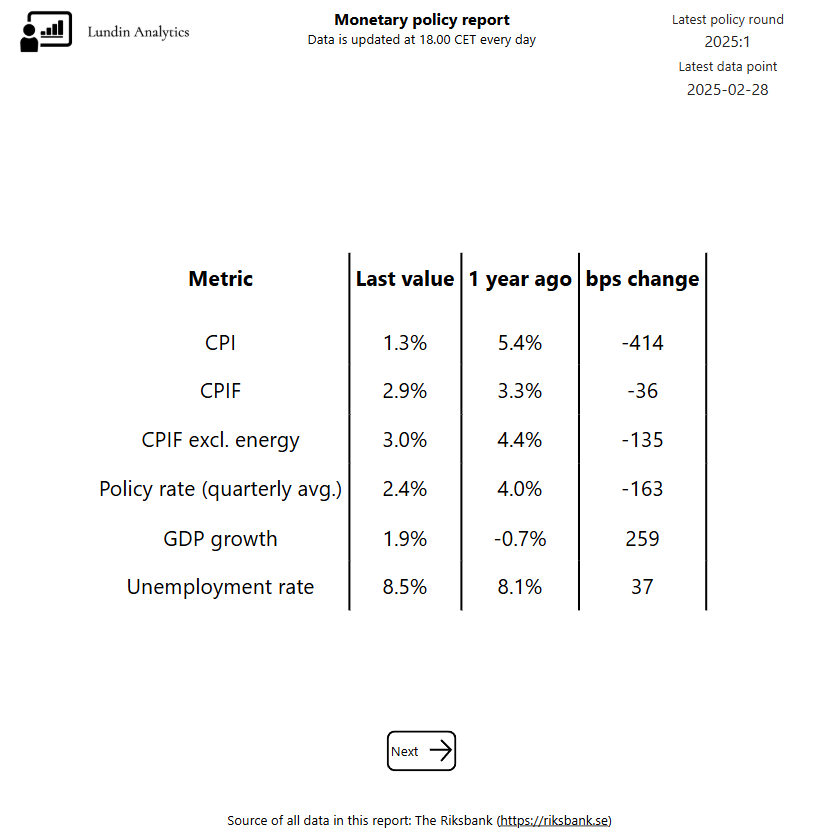

The figure below shows a summary of some KPIs that we thought give a good summary of the monetary policy data. For example, we can see that the CPI in Sweden has decreased from 5.4% to 1.3% in just one year. At the same time, the quarterly average of the policy rate has decreased from 4.0% to 2.4%.

CPI, CPIF excl. energy and the policy rate

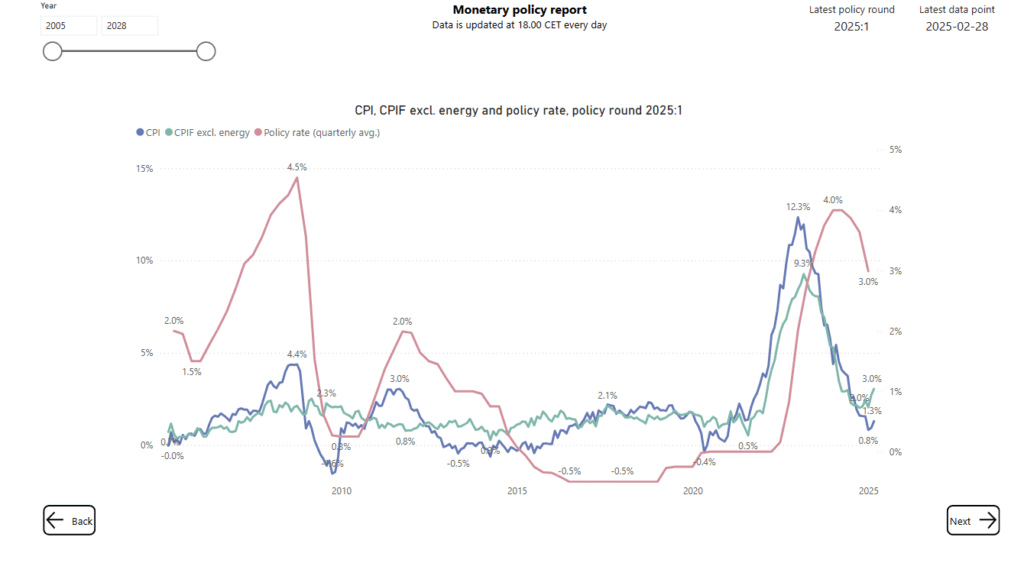

The next page of the report has a chart, where we zoom in on the relationship between CPI, CPIF excl. energy and the policy rate. The user has the possibility to filter the year from 2005 and onwards.

Here, we see that both CPI and CPIF excl. energy increased sharply around 2021. With a bit of delay, also the policy rate followed with an increase. Similarly, the CPI and CPIF excl. energy started to drop in early 2023. The policy rate decreased, again with a delay, in 2024.

Sweden’s GDP growth including forecast

On this page, the user has the possibility to zoom in on Sweden’s GDP growth. We can see that there were large changes, both upwards and downwards around the 2020 to 2021 time frame. The forecast is also presented. The current forecast, which was created around the policy round 2025:1, forecasts a GDP growth around 2% to 3% in the coming years.

Summary

The Swedish central bank – the Riksbank provides a REST API with monetary policy data. By connecting Power BI to the REST API, we were able to look at key monetary policy KPIs such as CPI, CPIF excl. energy and GDP growth.

More blog posts

Reading monetary policy data from the Riksbank via REST API Read More »